My dad tells me that I was born during the depths of the Great Recession, an economic downturn so severe that it hadn’t been experienced in generations. That of course caused a big stock market decline but had you panicked and sold, you missed out on one of the greatest stock market booms that followed in like forever.

That’s not quite market timing (it is panic selling) but it usually is the outcome of investing without a plan. Why are we investing, what are we investing for and what are we investing in is super-critical to know if we have a fighting chance to stick with our investments during eventual market declines.

Because without that, without that conviction, we’ll end up making decisions that are more emotions-driven than following a blueprint on what to do when such downturns occur.

And they will recur because volatility, I mean ups and downs in the prices of stocks, is inherent with the stock market but given enough time, stocks will and do recover to reach new highs.

As they did from the last time around when stock prices dropped big. That is again a feature of how the stock markets work.

So to give you a primer on how difficult this market timing game is, take for example the year 2020 that started off just like any other year. And then came this little virus out of nowhere and the entire world stopped. I mean no school, no restaurants, no travel. The economy suddenly literally ground to a halt.

And we know what that means. A big stock market crash. And it happened. They say it was the fastest decline in the value of businesses by the extent the stock market dropped.

But then the market recovered and that too in a matter of weeks.

But had you sold at the bottom and many people did assuming things were going to get a lot worse, well, now you have a problem.

And that always is the big danger. I’ll get to the why later but let’s run through some numbers on why it would have been a bad idea to even attempt to time the market.

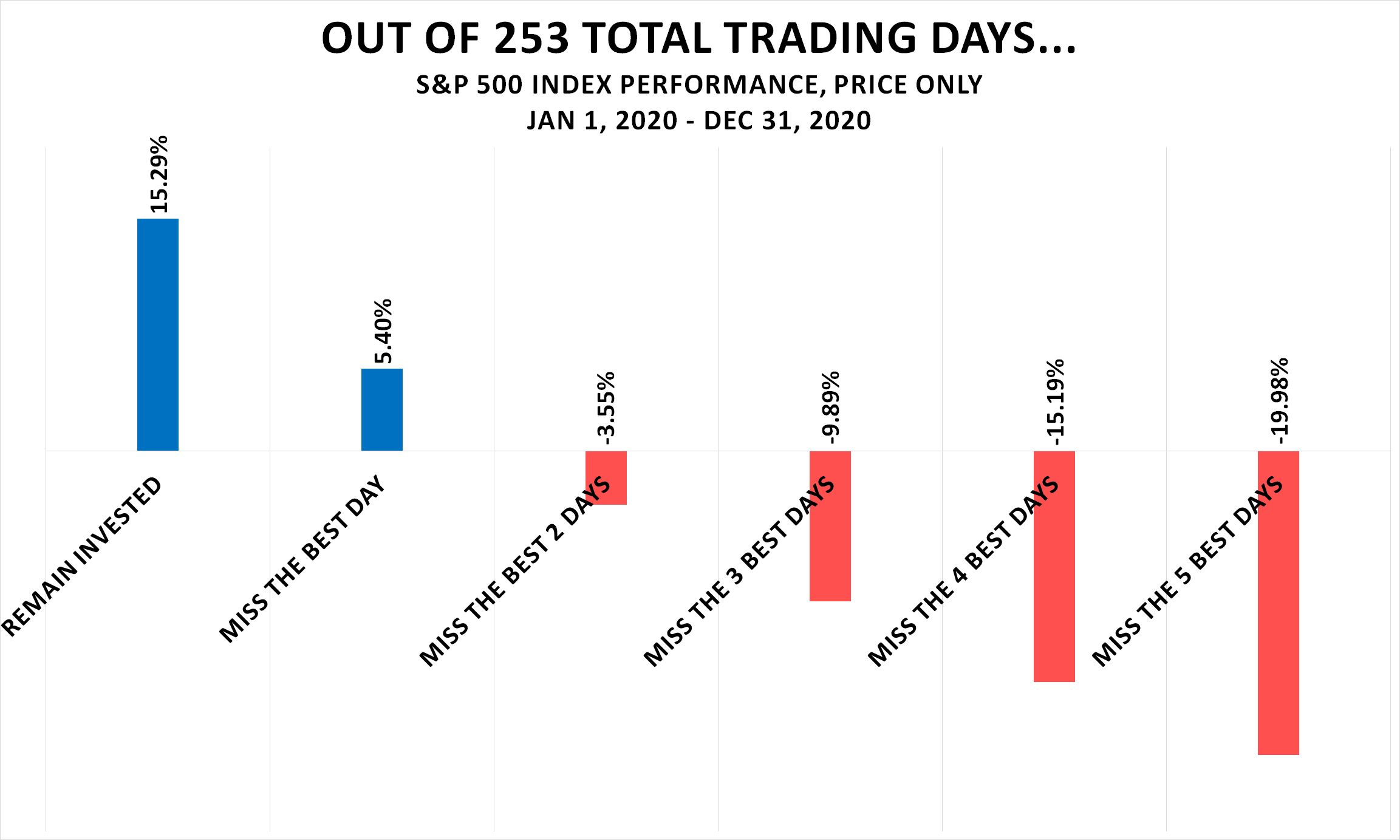

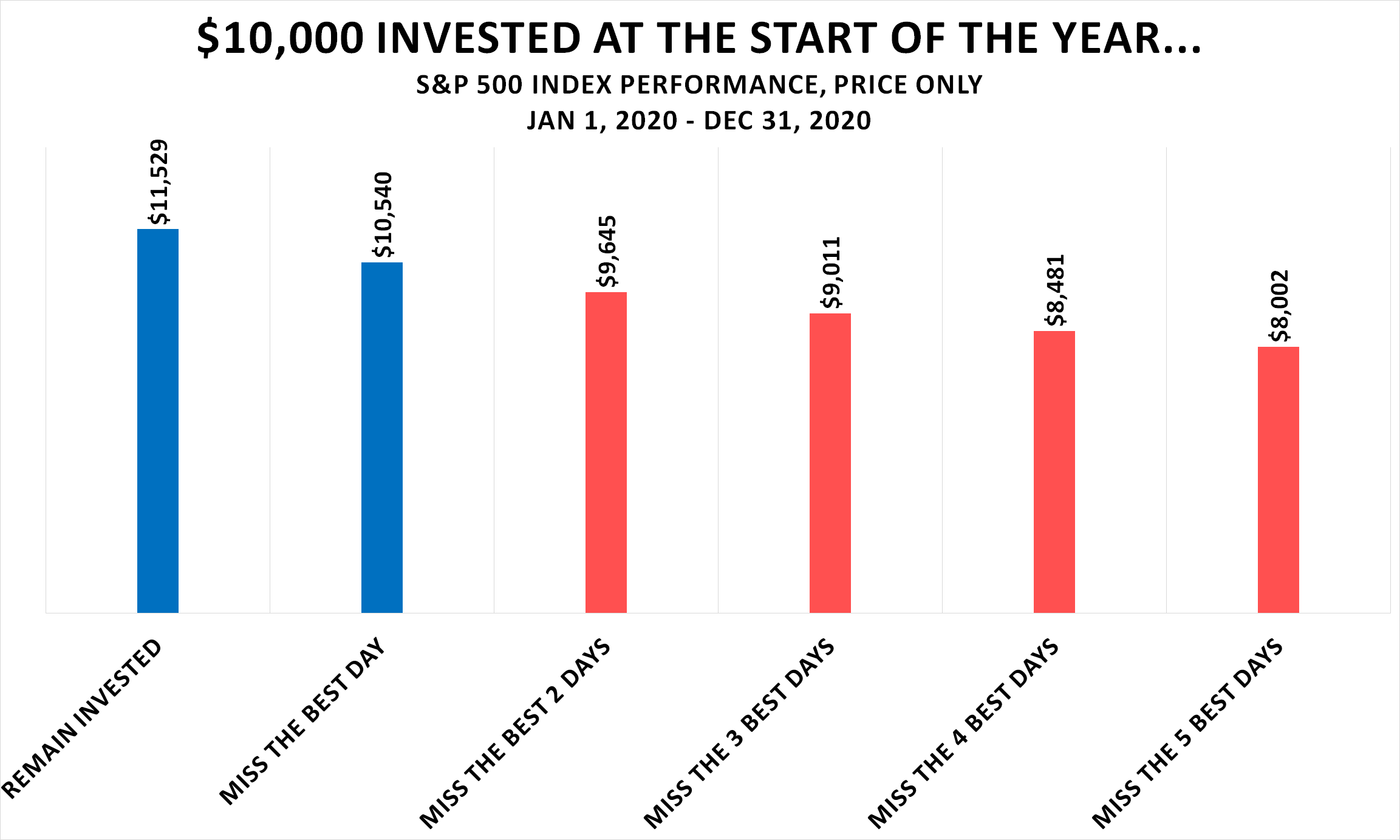

So there were 253 total trading days in the year 2020. Had you stayed invested all through the year and though not ideal, if all you owned was a large company fund like the S&P 500, yes, you would have had to live through intense volatility but you did good. I mean you made 15.29 percent on your money.

But had you sold to buy back into the market at a later point and missed the single best day, your return for the entire year would have dropped by two-thirds.

So miss just one day and your return drops from 15.29 percent to 5.40 percent. That’s crazy.

And that usually is the most likely outcome if you were to attempt this market timing thingy since you’d always tend to get out at the worst possible days and the worst possible days are almost always followed by the best recovery days.

The best days are again lumped together and had you missed the best two days, you might just have been better off keeping your money safe in a savings account. Because missing just two of the best days turned a positive year into a negative one.

The plots below show all this in percent and dollar terms so don’t market time.

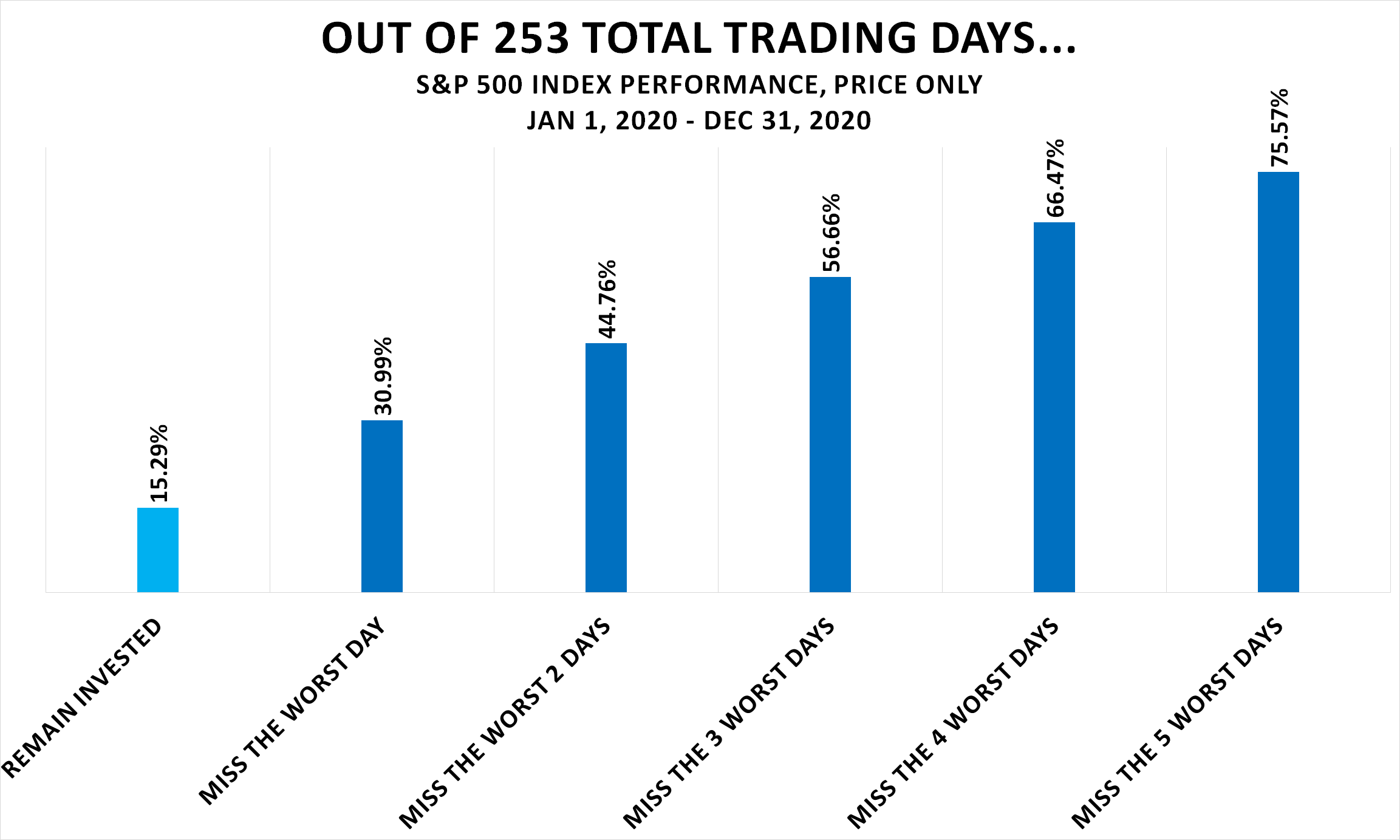

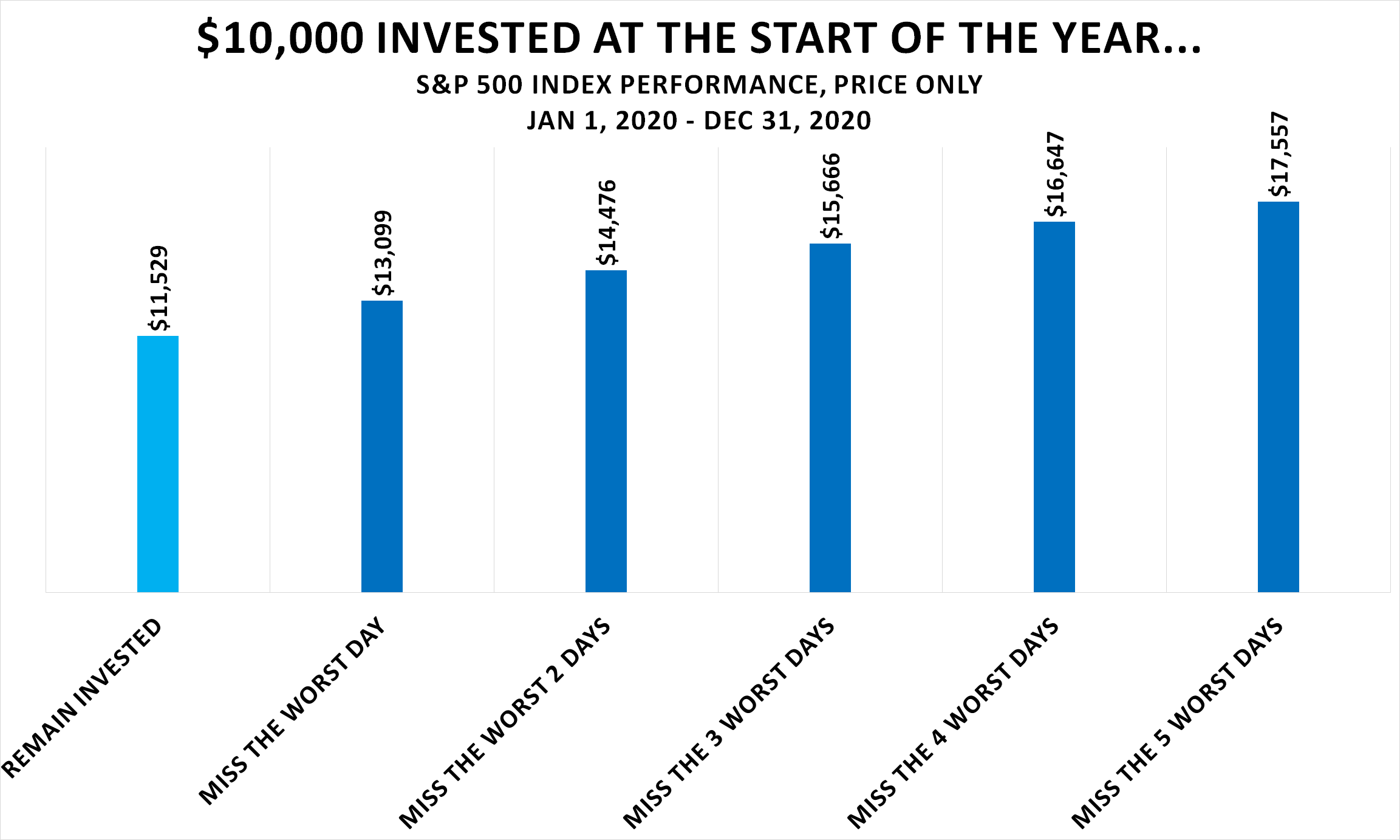

But why show missing only the best days? What would it look like if I were to miss the worst days of the year?

Fair question and you’d be right. You’d have quite a bit more money if you were able to somehow navigate out of the market before the worst possible days and were somehow able to get back in time to enjoy the recovery.

And the data that shows just that.

But we all know how hard that is. I mean the math is plain impossible. Let me show you why.

So there were 253 trading days in the entirety of the year. Your chance of missing the single worst day is of course 1/253 = 0.004 or 0.4 percent. Not only are your odds low but even if you timed it perfectly, it’s not like you made the kind of killing that would have changed your life.

Missing the two worst days brought you quite a bit more money but then your chance of successfully pulling that off is 1/253 x 1/252 = teensy tiny small. You might as well play the lottery.

And of course being able to time the market that lets you avoid all five of the worst days are out of the world remote.

So don’t market time.

And all this ignores tax consequences and all that time you’ll spend away from what you are good at, constantly watching the markets and the emotional heartaches that’ll bring you. Because trust me (my dad), this thing can be quite draining.

So again, don’t market time.

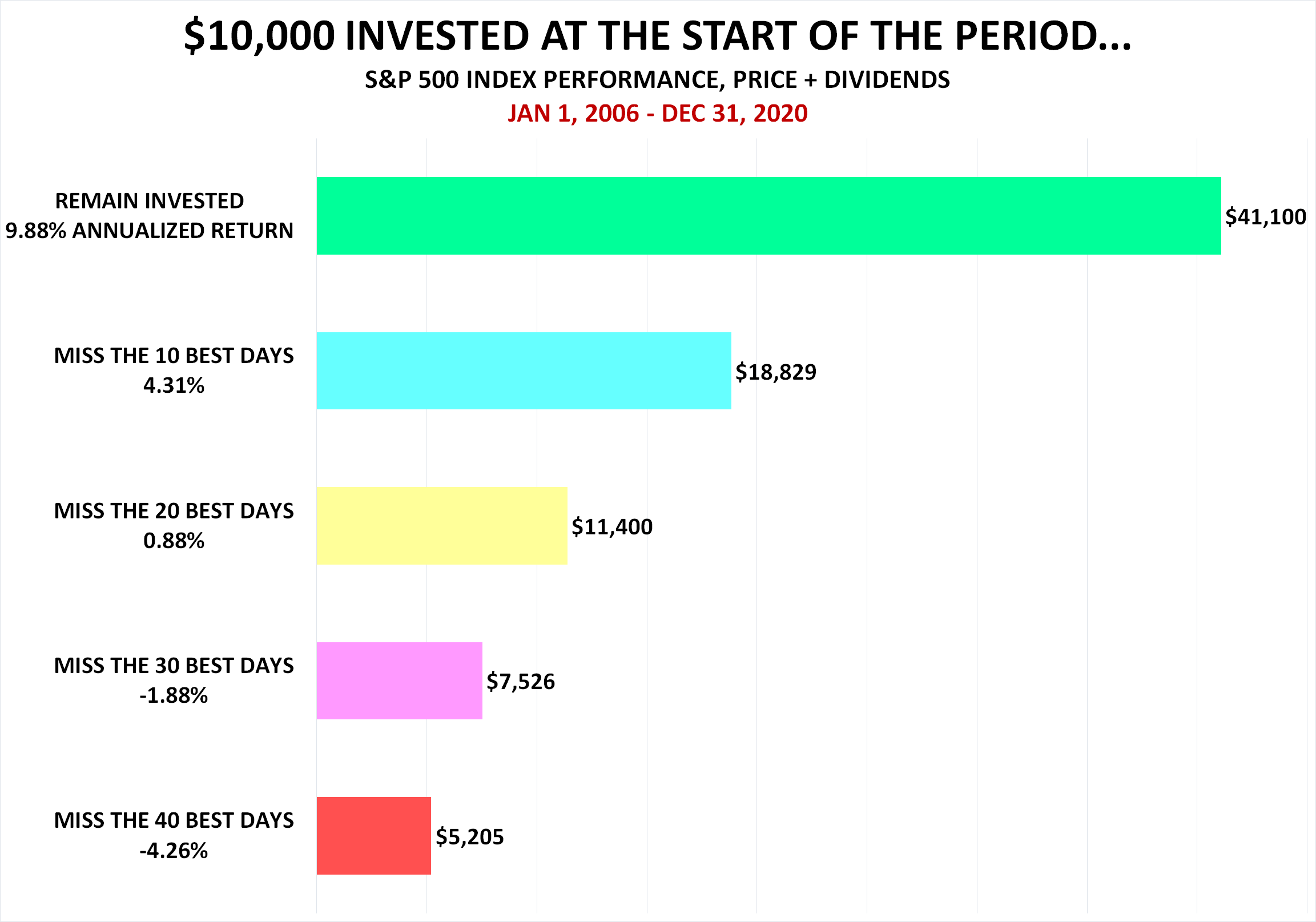

And the same plays out over longer timeframes.

Miss the 20 best days out of thousands over this 15-year stretch and you might just have parked your money under your mattress.

And here’s the biggest problem with market timing. Say you sell at the worst possible times thinking that things would get even more worse and they do, there is almost no chance you’d be willing to pull the trigger to get back into the game because then you’d wait for things to get even more worse.

So you wait and out of nowhere, the market turns and turn it does violently. That is what always happens. And now it goes past the point you sold at.

Now you are stuck, hoping and praying it (the stock market) falls again. And it never does. Because stocks as a collection are inherently designed to rise in the long run. They must. That’s the nature of the game.

So again, don’t market time. Don’t give up on the guaranteed returns that the global stock markets will deliver over time for that fake allure of being able to dance in and out of the markets.

And the best way to protect against caving to that lure of market timing is to follow a plan. Any plan, regardless of how sub-optimal it might appear to be is better than no plan. And then come hell or high water, stick to that plan.

I bet you’d come out a-okay.

Thank you for reading.

Cover image credit – Monstera, Pexels