William Howard Taft, the nation’s 27th President, established the first Federal income tax in 1913 which then went on to become a permanent part of the American life. But how did the system survive before that? It’s not like taxes didn’t exist. They did but they were mostly consumption based applied to things like liquor, beer, wine and tobacco…aka sin taxes.

But then you didn’t have much roads to build and maintain or government programs to run or the school system to educate or much of police, fire or military. They all came about and they cost money and hence the situation now.

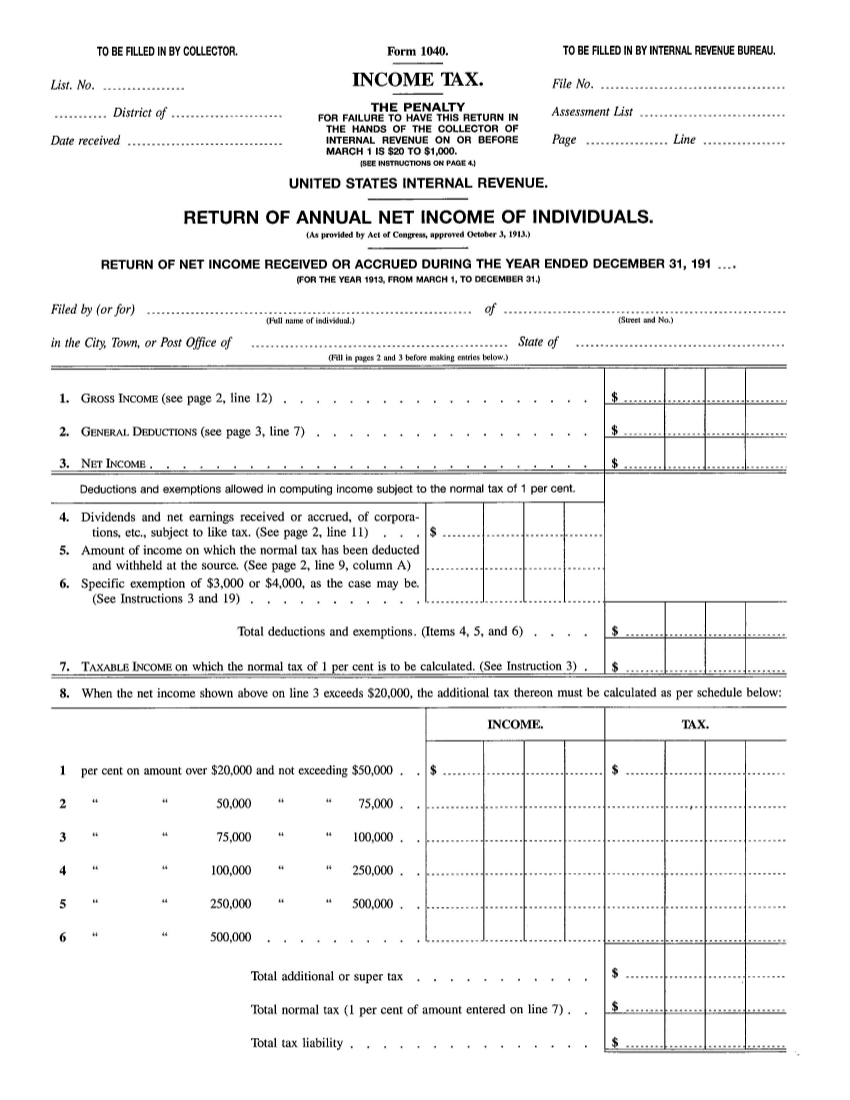

The Federal income tax started out small with a base rate of just 1 percent on personal income but that came along with an exemption (no taxes) of $3,000. That virtually exempted the entire middle class from paying any taxes. On incomes above $20,000, there was an additional surtax of six percent.

And we are talking 1913 dollars here so a $20,000 income back then was huge. So only the super-rich had to worry about paying any taxes at all. 1913 by the way was also the birth year of the form 1040 that you still use to date to report and file your Federal income taxes.

So a simple little form that even a fifth grader could understand and file. But that was in 1913. That same form today goes on for pages and pages with all the modifications and additions to the tax code over the years. So not a simple process to file anymore.

But Federal income taxes are not the only taxes you owe each year. There are payroll taxes (Social security, Medicare) you pay that directly come out of your paycheck. Then there are state and local taxes, taxes on dividends, capital gains taxes etc. So taxes and more taxes. Approaching that 50% mark in terms of the total taxes you pay each year is completely plausible in some cases.

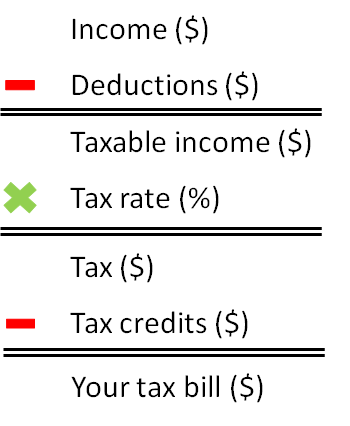

Now that you are happy, the system the way it’s designed is also fair. Or say fairer. That is, it’s progressive. As you make more money, you pay more in taxes. We’ll dig into that a bit more but before that, this is the general outline of our tax code.

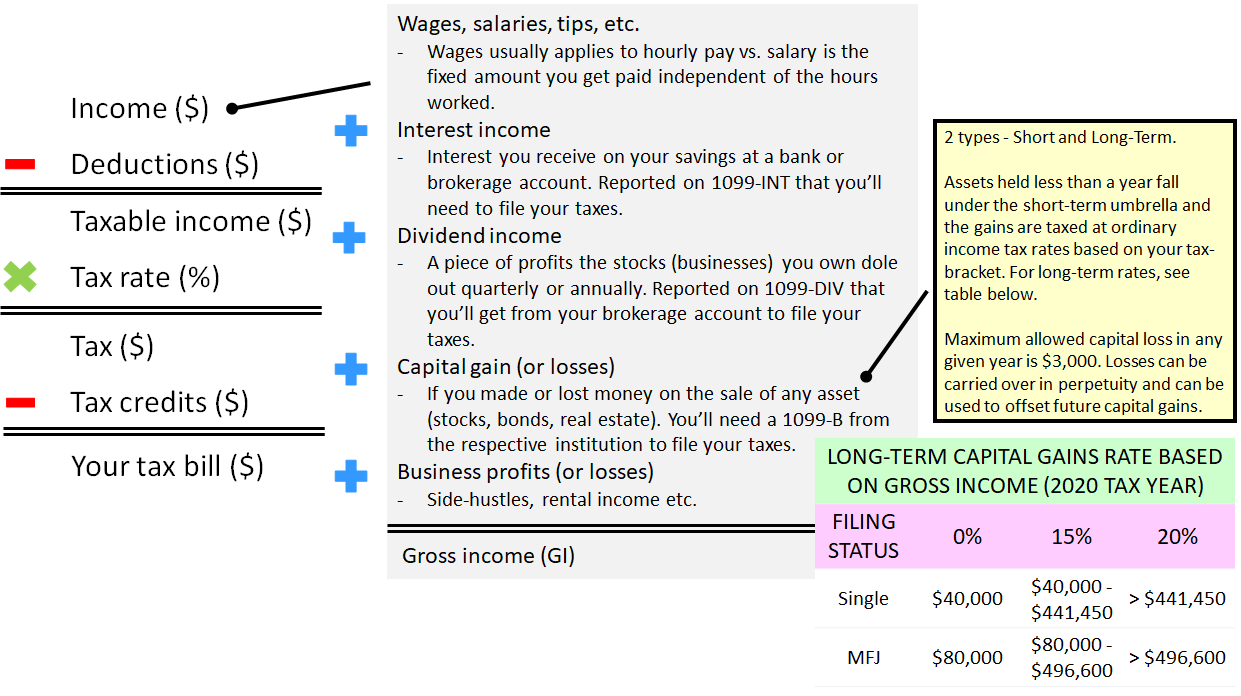

Income is a combination of all things below.

Wages and salaries are typically what’s reported on Box 1 of your W-2 that you’ll need to file your taxes. Unless of course you are an independent consultant/contractor and receive a 1099-MISC with income reported on Box 7 of that form. That’s akin to running a business and hence is reported as business profits (or losses) in the income section above.

You could have both W-2 and 1099-MISC incomes in any given year if you have any sort of a side-hustle apart from your day job. And many do.

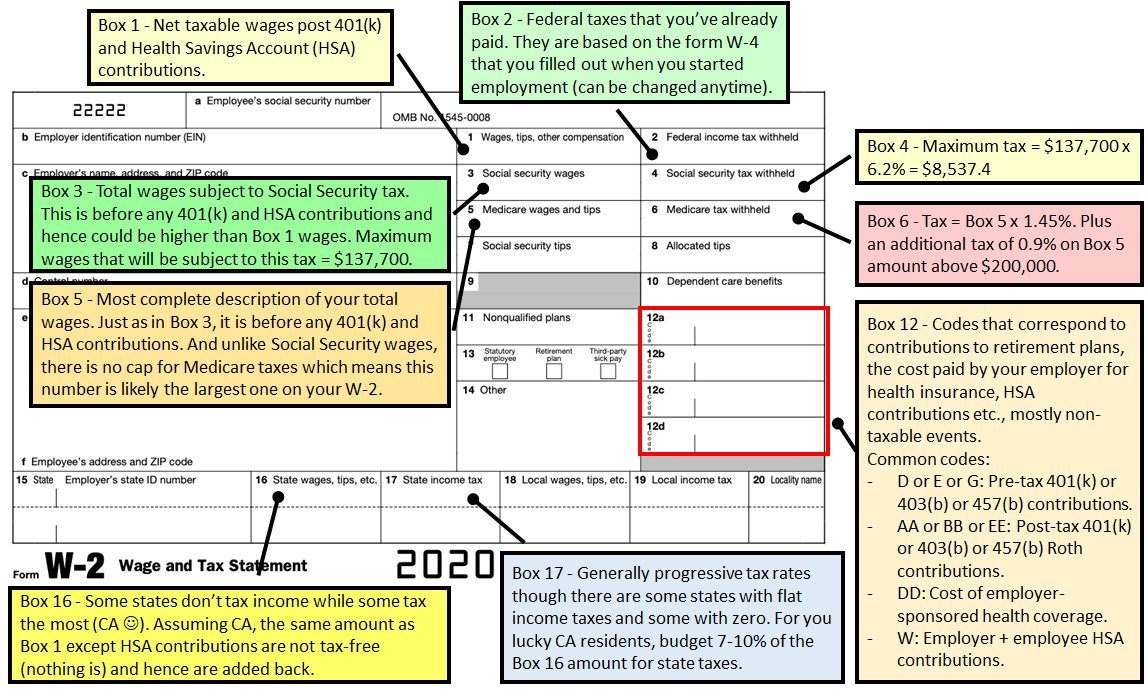

So what’s on a W-2? A detailed breakdown below…

The total Social Security taxes you paid for a year are reported on Box 4 of the W-2 and Medicare taxes on Box 6. Now it’s not completely fair to call them taxes as these are monies that you put in a system that pays for retirement and healthcare expenses for folks who are currently retired. But when you are done working and reach an eligible age, you’ll get some or most of it back from folks who are working and paying into the system then. So it’s a societal construct and a promise that’s made between generations and it’s an overall good thing. Not perfect but good.

But there are questions with respect to the sustainability of these constructs which we hope the leaders we elect will help resolve over time.

Apart from W-2 and 1099-MISC incomes, there is interest income that’s reported on something called 1099-INT that you’ll get from your bank that reports the interest income you earned on your savings for the year. You likely won’t have to worry much about earning anything on your savings these days though but you could if your stash has any heft.

Then there is dividend income that you’ll have to pay taxes on if you own stocks (publicly traded businesses) and when those stocks distribute profits back to you, the owner (stockholder).

Capital gains (or losses) are exactly that – gains or losses on an asset from the time it’s purchased to the time of its sale.

And business profits (or losses) we know. It could be anything that you make money off of and making money means paying taxes.

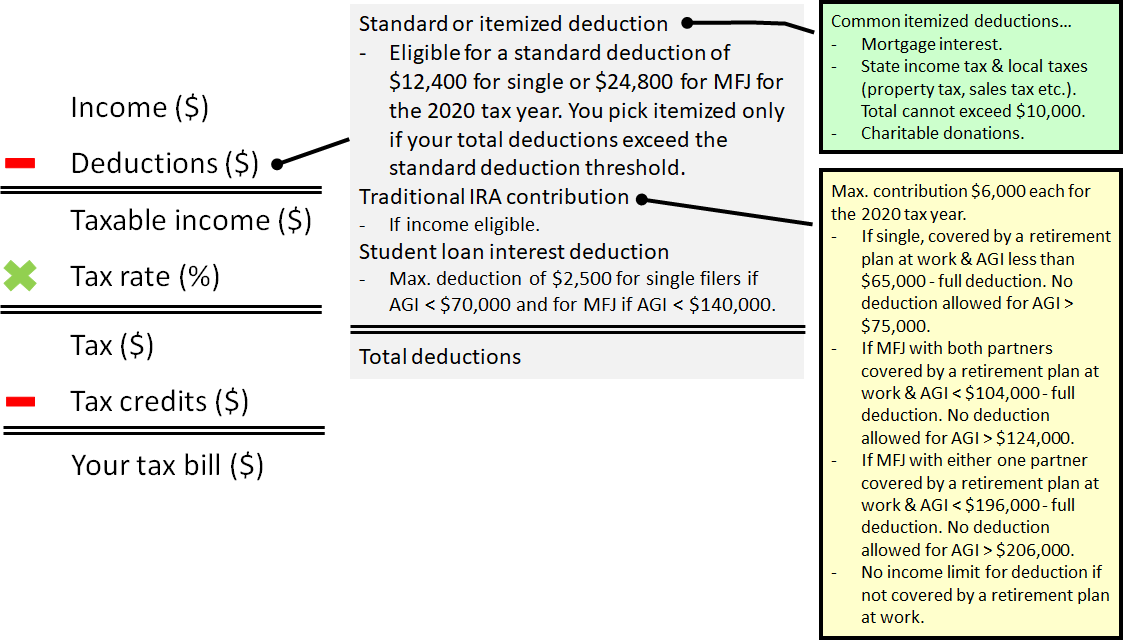

So that’s all the income but you don’t pay tax on all of that. You get to deduct a few things from that income to arrive at net taxable income.

What can you deduct? The most common ones below…

Your taxable income reduces by the amount of deductions allowed. So say your gross income is $50,000 for the year and you are filing as a single person and you rent instead of owning a home, your taxable income reduces by the standard deduction of $12,400 and you get taxed on the remainder of that.

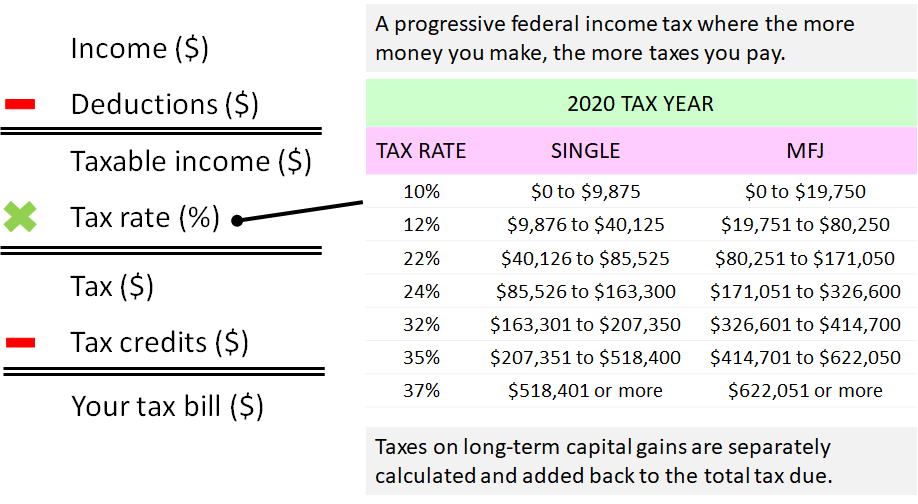

Then comes the actual calculation of the tax due. We are part of a system that taxes income progressively. Almost all taxes are by the way. The more money you make, the more taxes you pay. It’s debatable whether it does an overall good or not and one can argue that at the margins, it does tend to discourage incentives to make more. I mean if you are in the highest tax bracket and the fact that the next set of dollars you earn, almost half of that is going to be taxed away anyway, that does create a little bit of discouragement to go out and make those dollars.

But then a healthy country needs a healthy middle class else we’ll all be living in armed and gated communities like many affluent folks do in other parts of the world where extreme gaps between the haves and the have nots persist.

But the system we are part of (capitalism), if not corrected from time to time, does tend to perpetuate accumulation of capital in the hands of the few. That’s the way it is designed so a bit of income and wealth distribution is for the overall good. Hence the tax structure the way it is.

And this is how taxes are calculated…

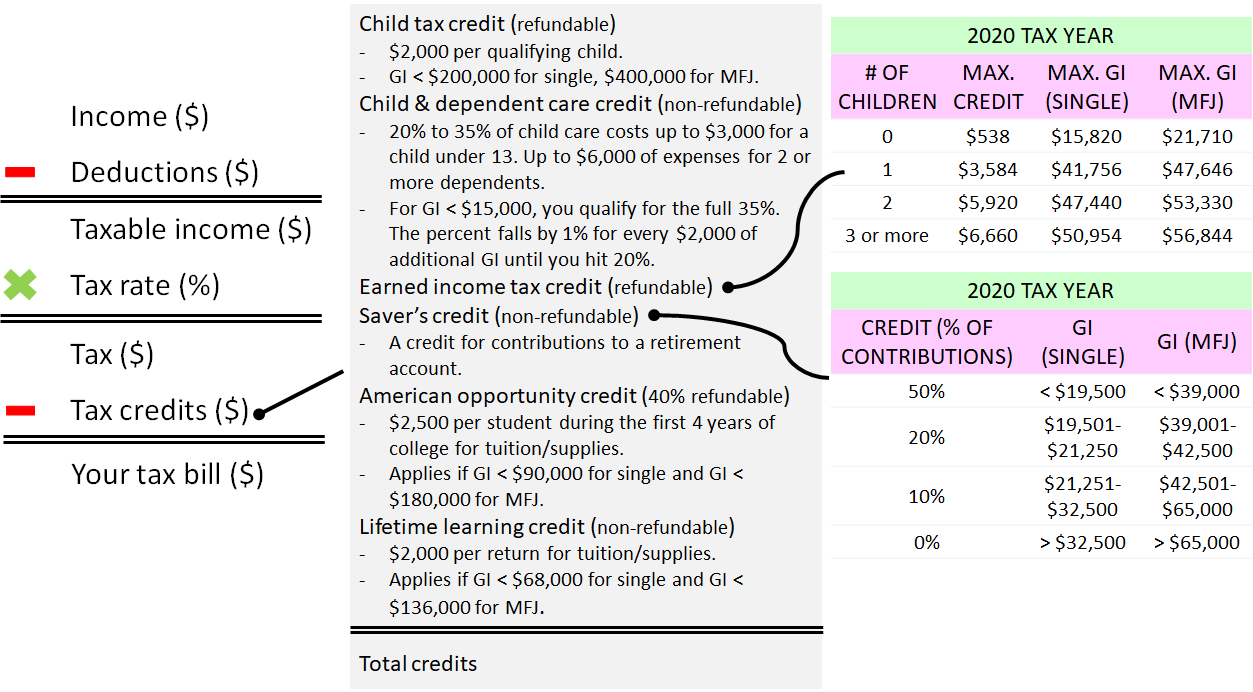

But then there are credits that directly reduce your tax bill. They are again designed to help folks on the lower income segment of the society to potentially help reduce or eliminate any tax liability thrusted upon them.

Tax credits fall into two camps; refundable and non-refundable. If a refundable tax credit exceeds the amount of taxes owed, the difference is paid as a refund. If a non-refundable credit exceeds the amount of taxes owed, the excess is lost.

Let me clarify that with an example. Say your tax due comes to a $1,000 and a refundable tax credit that you qualify for is in the amount of $1,250, you’ll get the difference in $250 back as a refund. But if that tax credit were non-refundable, your tax bill will drop to zero but you will not get any money back.

So not only do you pay no tax but you could get money back from your fellow taxpayers, if you qualify.

And after all that math, you get to your final Federal tax due bill. Then you’ve got state income taxes if they apply. Plus city taxes in some cases (New York City).

Now that we know a bit about how taxes work, let’s run through some scenarios to see what an individual’s total tax bill could amount to and what could be done to lower that.

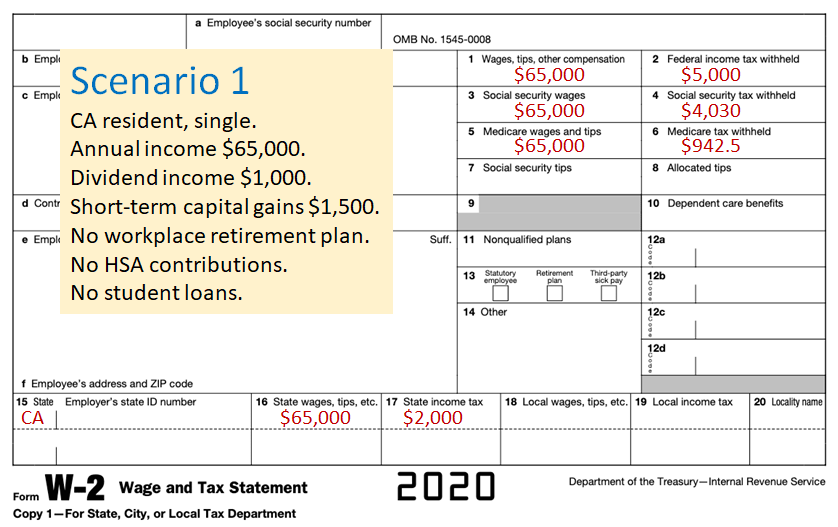

This, for example, is a W-2 this single wage-earner residing in CA gets at the end of the year.

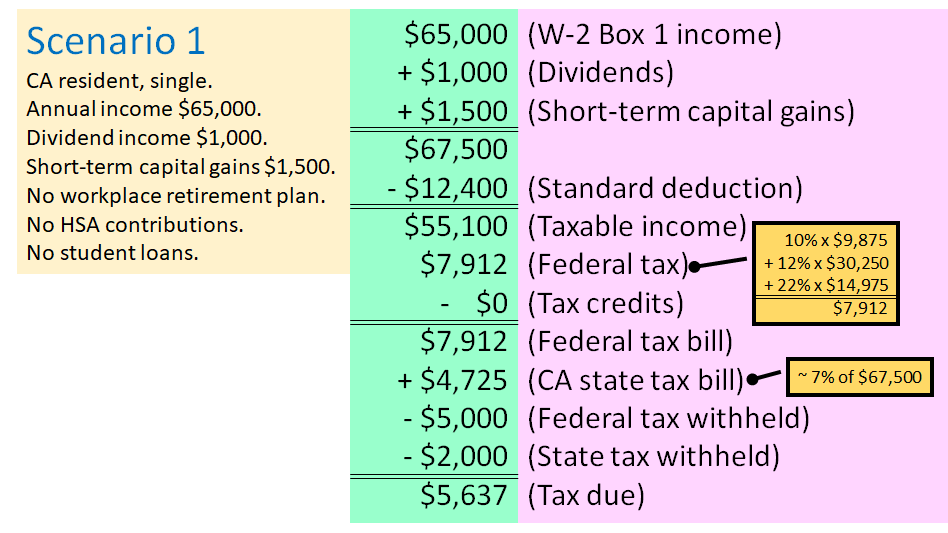

The taxes he or she ends up paying when filing a tax return that everyone MUST do come April 15th of each year…

But that’s not all the taxes this individual pays for the year. A complete list…

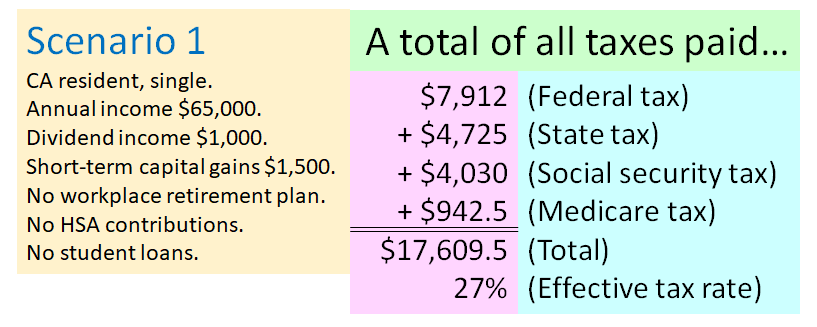

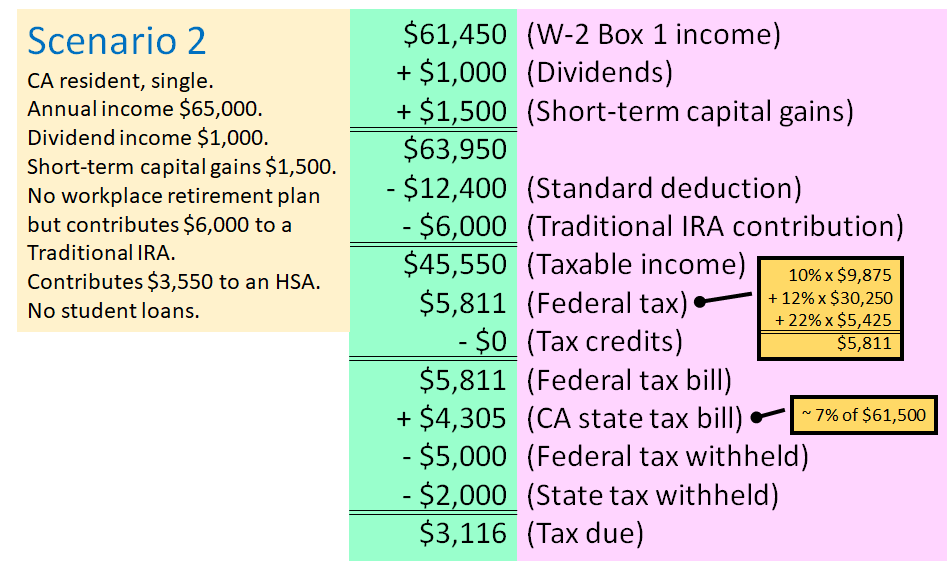

Let’s take this same individual but this time around, he or she contributes to an IRA and to an HSA. The updated W-2…

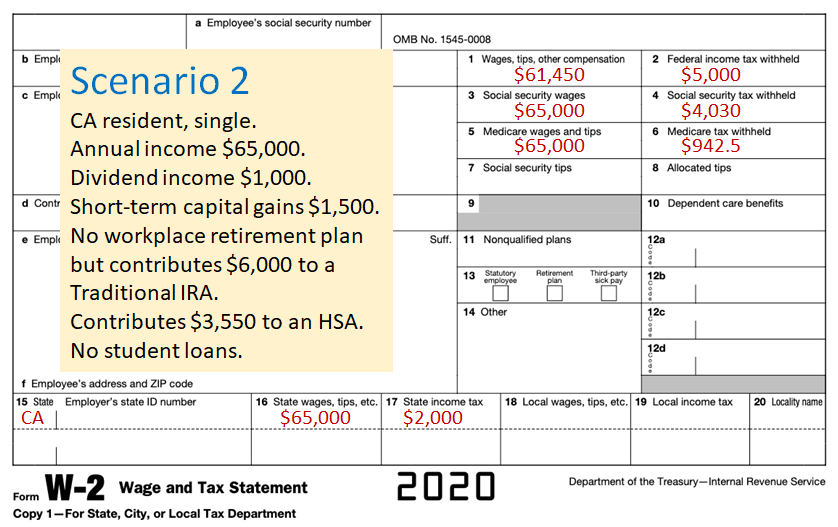

The tax math when filing taxes…

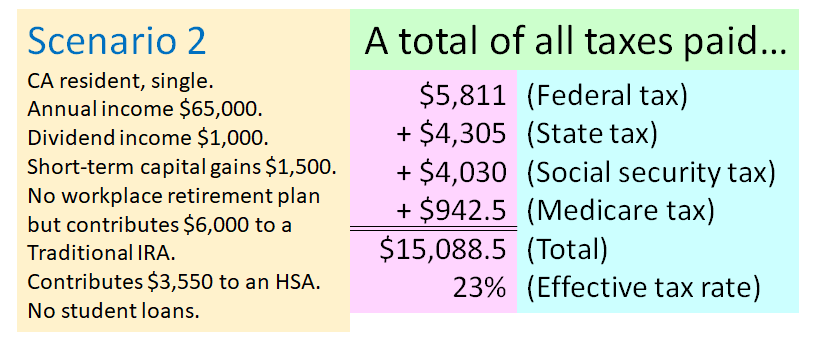

His or hers total tax bill for the year…

So not only was this individual able to lower his or hers tax bill but now there is money that is invested on a tax-deferred (IRA) and tax-free (HSA) basis till retirement. So much better.

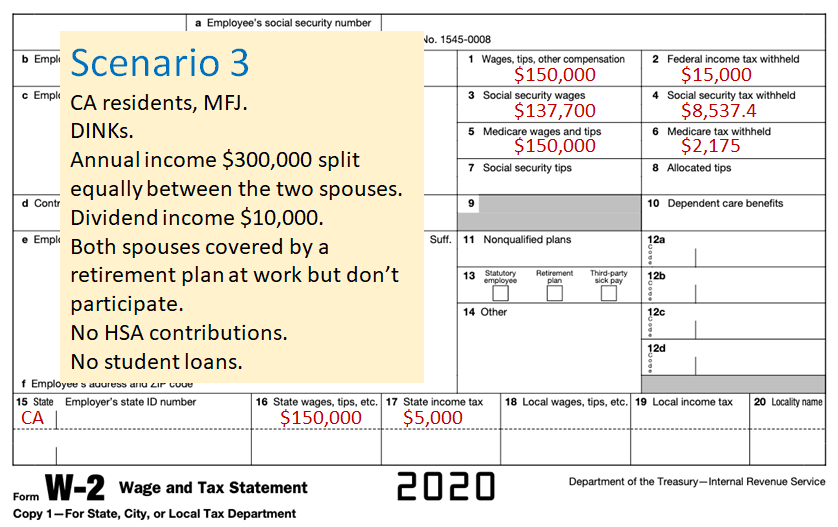

Let’s look at a few more scenarios. Here’s one where now we have two wage-earners with no kids (dual income, no kids, I mean DINKs) making great incomes and also CA residents. Both partners get a W-2 each at the end of the year and for simplicity’s sake, we’ll assume that to be the same for both.

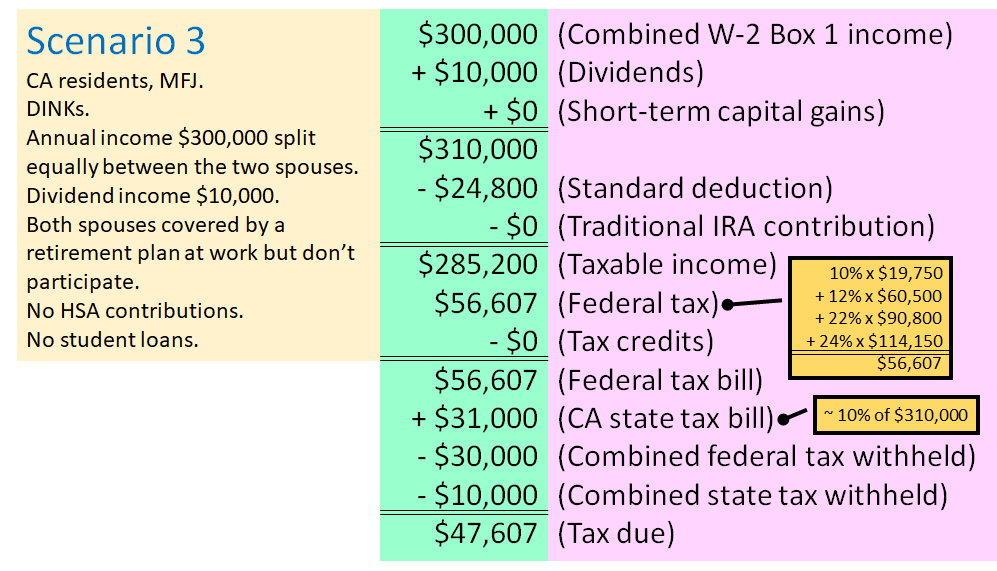

So even with access to a retirement plan at work, both decide not to participate. The tax math hence…

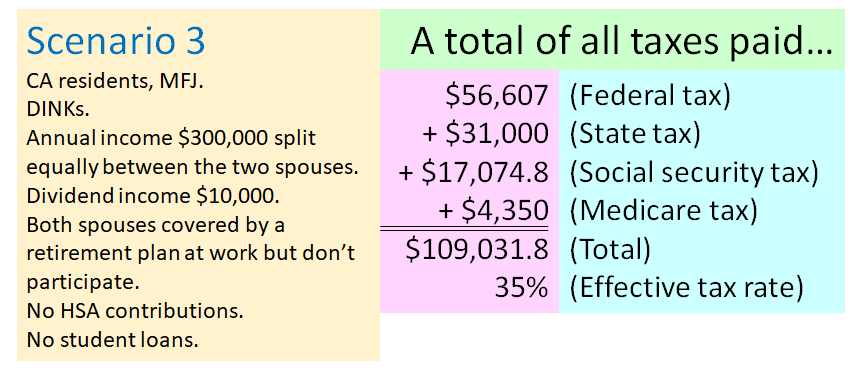

The combined W-2 Box 1 income is 2x of what’s shown in the W-2 because dual income. The total of all taxes paid…

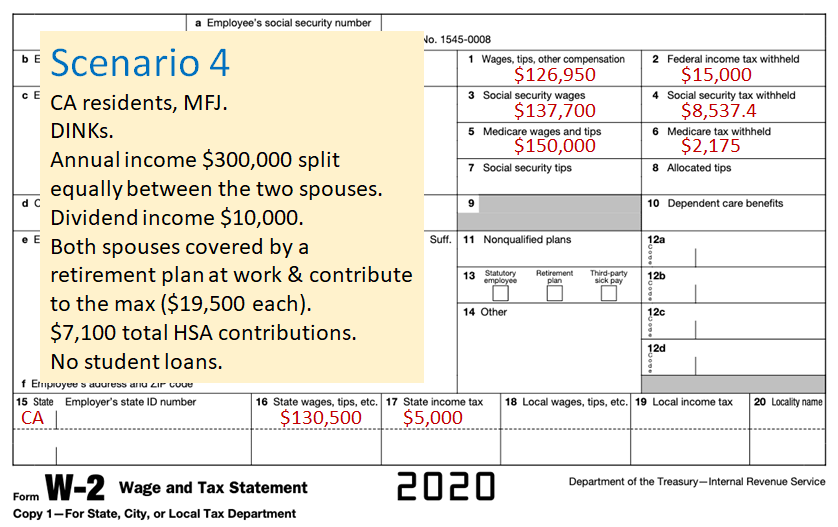

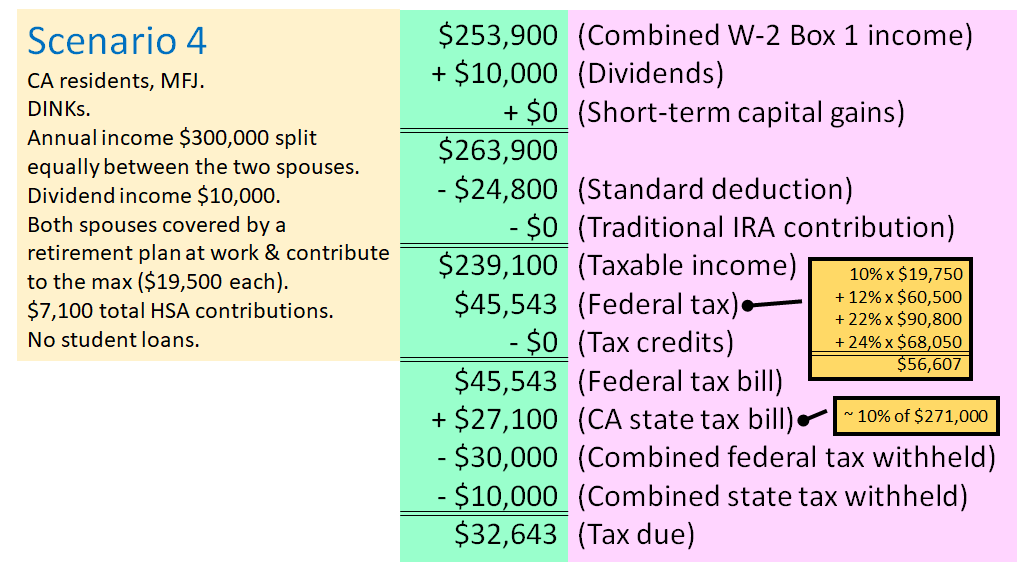

So not fun. But doing the same tax math assuming they had done what they should have done…

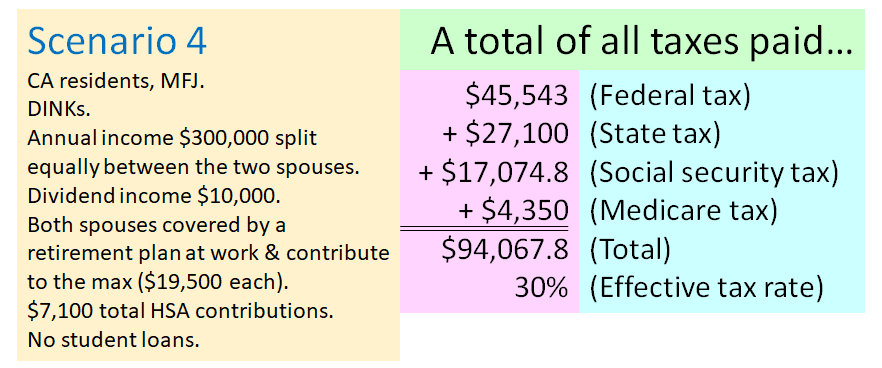

And the impact on total taxes paid…

So about $15k in total tax savings for the year by doing it right.

Of course, there are many permutations and combinations with the complex tax code we have but this hopefully gives a good overview of how our taxes work. And this applies to most of us.

Now only if we could figure out a way to make our government spend our tax dollars ‘right’.

That does it. Thank you for persevering through something as dull and dry as taxes. Not as fun to write about but necessary.

Until later.

Cover image credit – Oladimeji Ajegbile, Pexels