Benjamin Franklin once said “A penny saved is a penny earned.” But I say there is more to that. Not only is a penny saved is a penny earned but a penny saved today is worth quite a bit more than say saving that same penny tomorrow or the day after. Hyperbolically speaking, of course. And here’s why.

Say you are 20 years old today and you invest a dollar at say 8% annual rate of return and leave it invested till you are 65. What would that dollar become? 34 dollars.

But say for some reason you waited till you were 30. So instead of the thirty-four dollars before, you’d have less than half of that or about sixteen dollars. Wait another 10 years to invest and you’d have a mere $7. Wait till you are 50 and you’ll have just $3 at age 65. Another ten years and it’s over.

So start early.

But of course a few tens of dollars will not change anything for you. You need more, a lot more to meet goals that are much bigger than what a few dollars can provide. We hear all the time about what you have to do to become a millionaire. But that is so last century. I’ll revise that to how to become a multi-millionaire.

Or at least a double millionaire. And say that is the goal. And you want to get there as fast as possible because you don’t have a lot of time. You’ve got just one life and you have many things you probably want to do with it than just think about money.

So say you are fresh out of college and you are fortunate enough to be making a great income. What’s a great income? How about $100,000 a year.

I know it sounds big but I see and hear that a lot of college graduates make that kind of money nowadays, at least in the Silicon Valley that I live in.

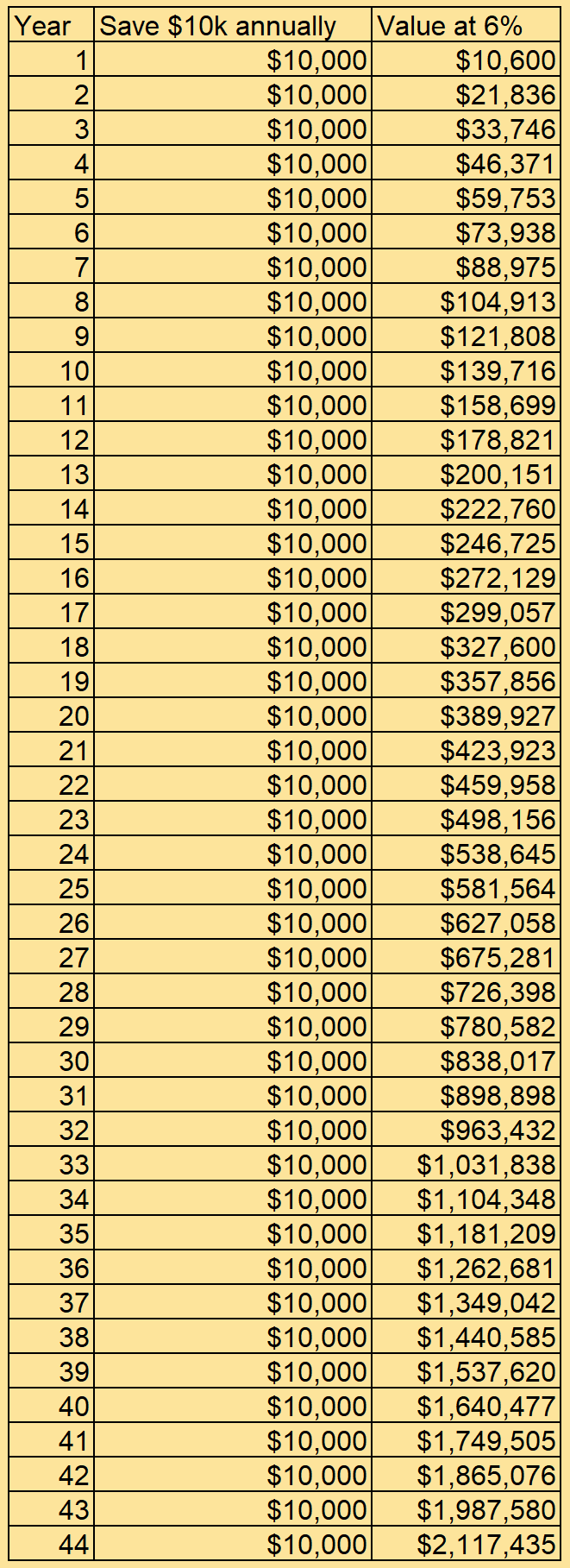

So say you take $10,000 of what you make each year and are able to invest that at 6%.

Oh wait, why 6%?

Yes, I did talk about 8% before but remember what we are trying to do here – we are planning for the worst and hoping for the best.

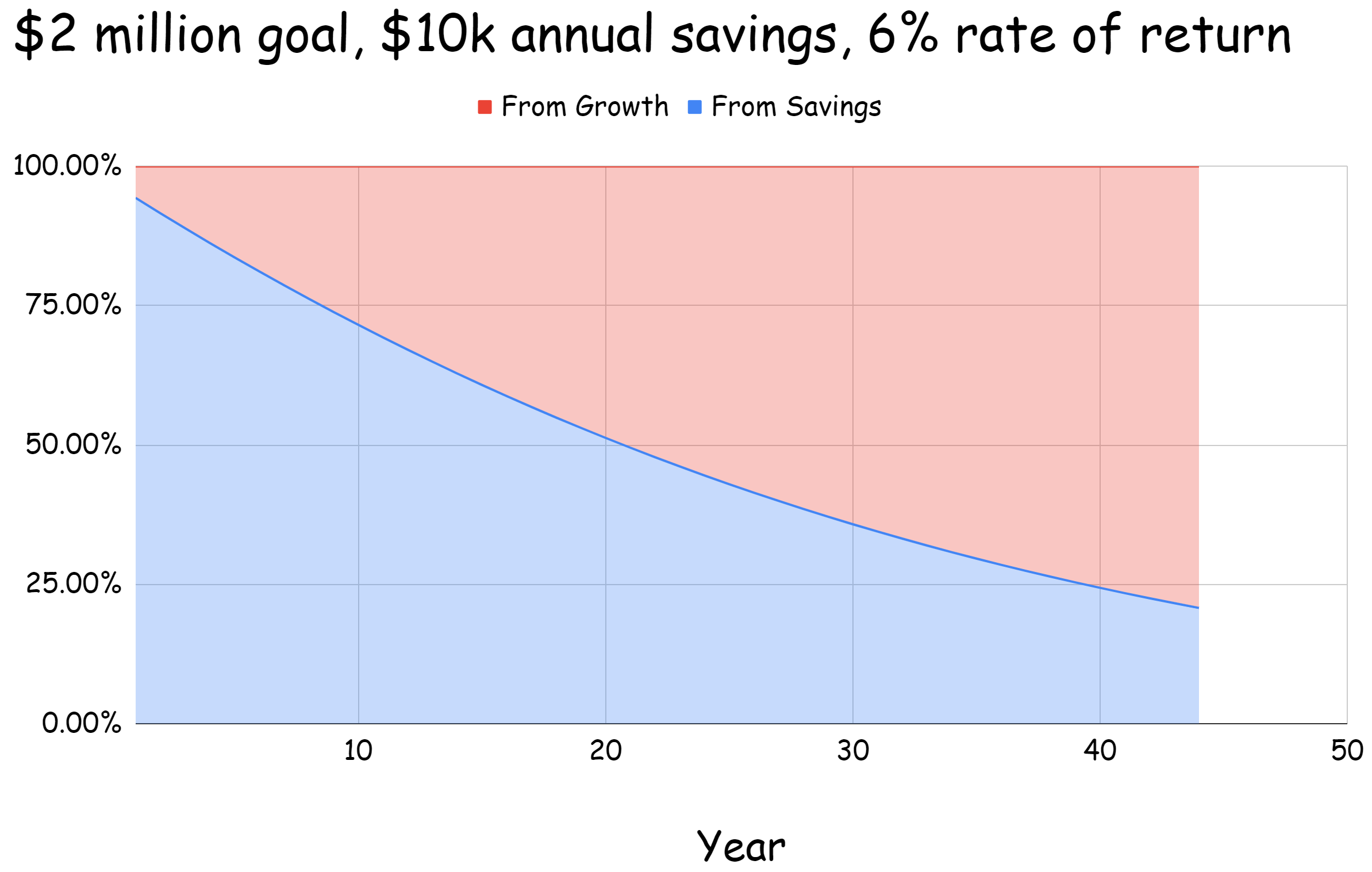

So let’s plan for our $2,000,000 goal assuming a 6% rate of return and $10,000 of annual savings.

And this is how it looks…

So 44 long years to get to that goal. That is way too long.

Can you speed that up? Yes, but it doesn’t come easy because that requires you to save more.

But I say it’s doable because you are making great income. All that’s needed is a little bit of discipline and expense management. It’s your life we are talking about here after all.

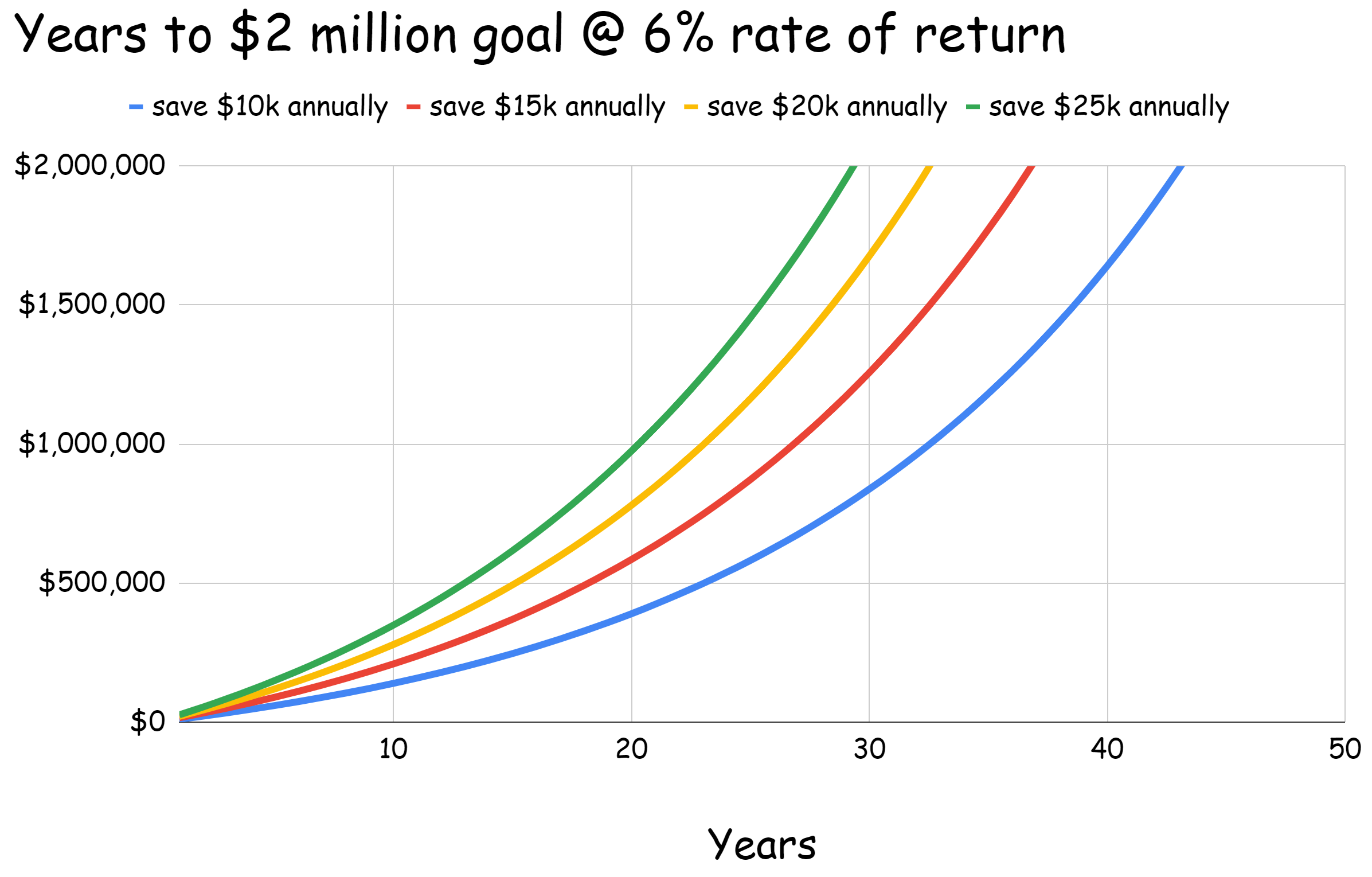

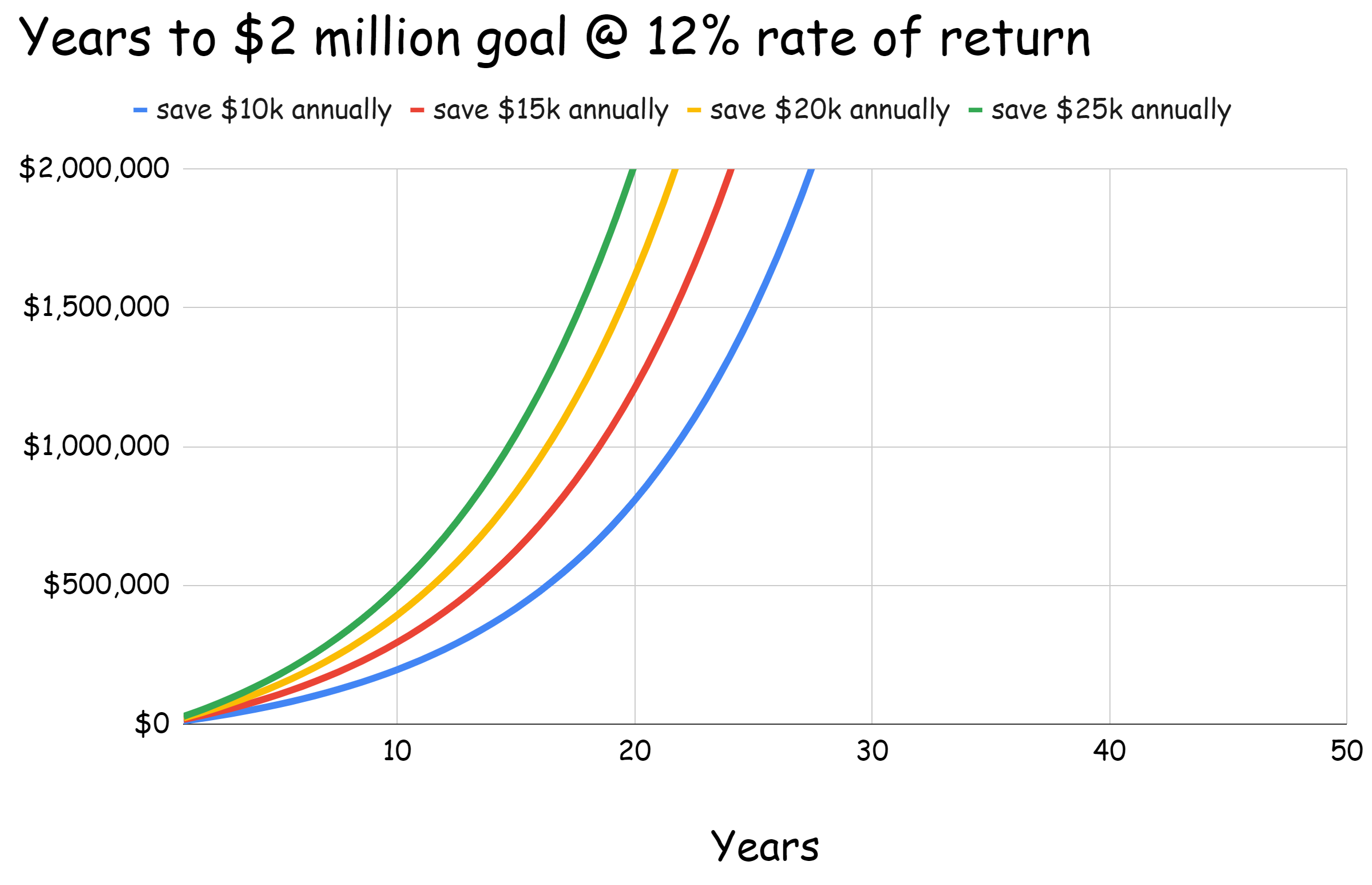

So here are four scenarios with four different saving amounts…

So going from saving $10,000 a year to $25,000 drops the number of years to reach your goal by almost 14 years. That is a lot of life you are getting to buy just because you were able to squirrel away more.

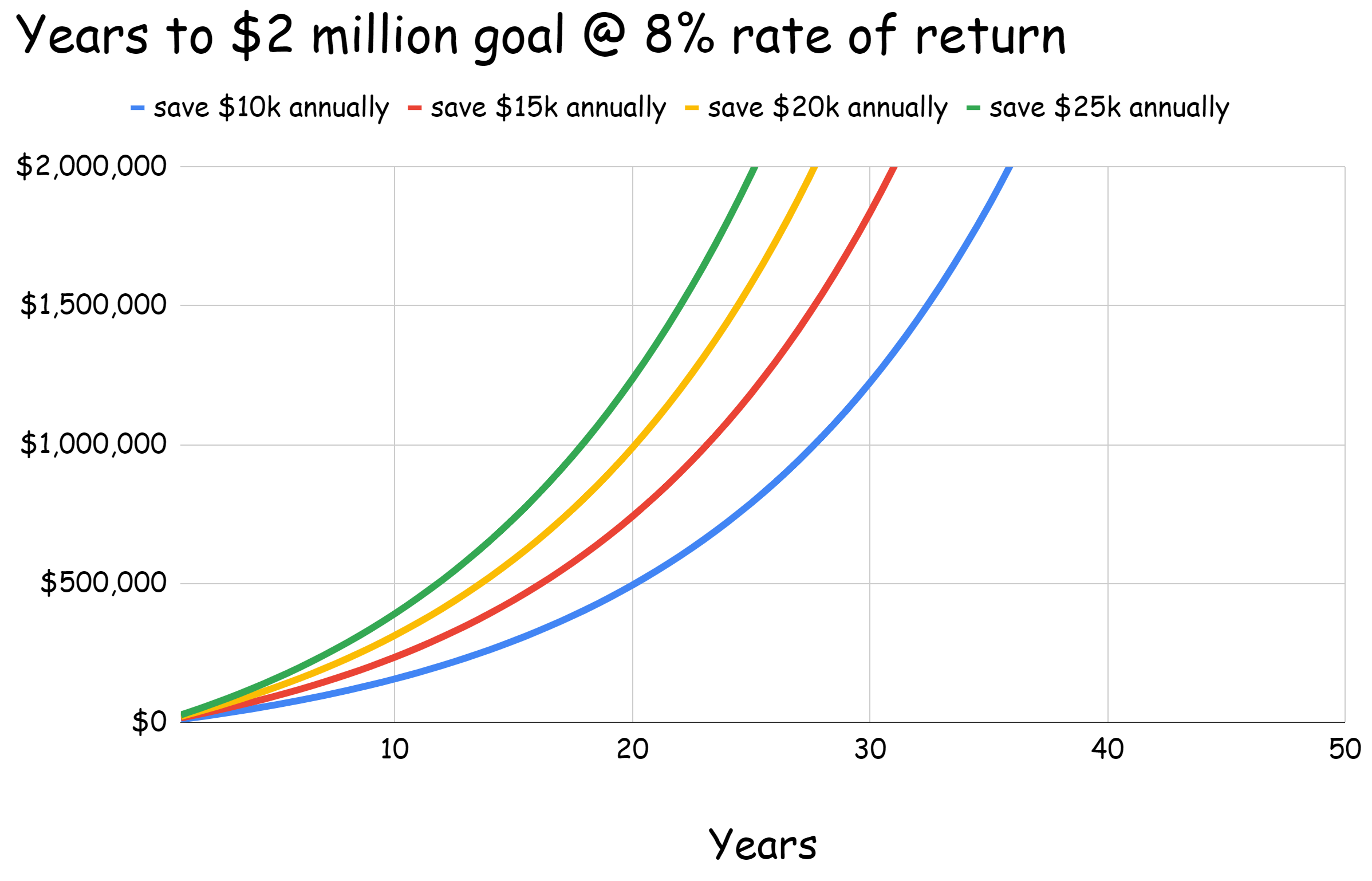

But what if you could earn a higher rate of return, say 8%. Now this is an aggressive assumption and it is completely possible but I wouldn’t count on it. But what would that do to your time scale?

So of course, you get to your goal faster because the rate of return is higher but did you notice that the gap in years between saving $10,000 vs. saving $25,000 is not as wide anymore?

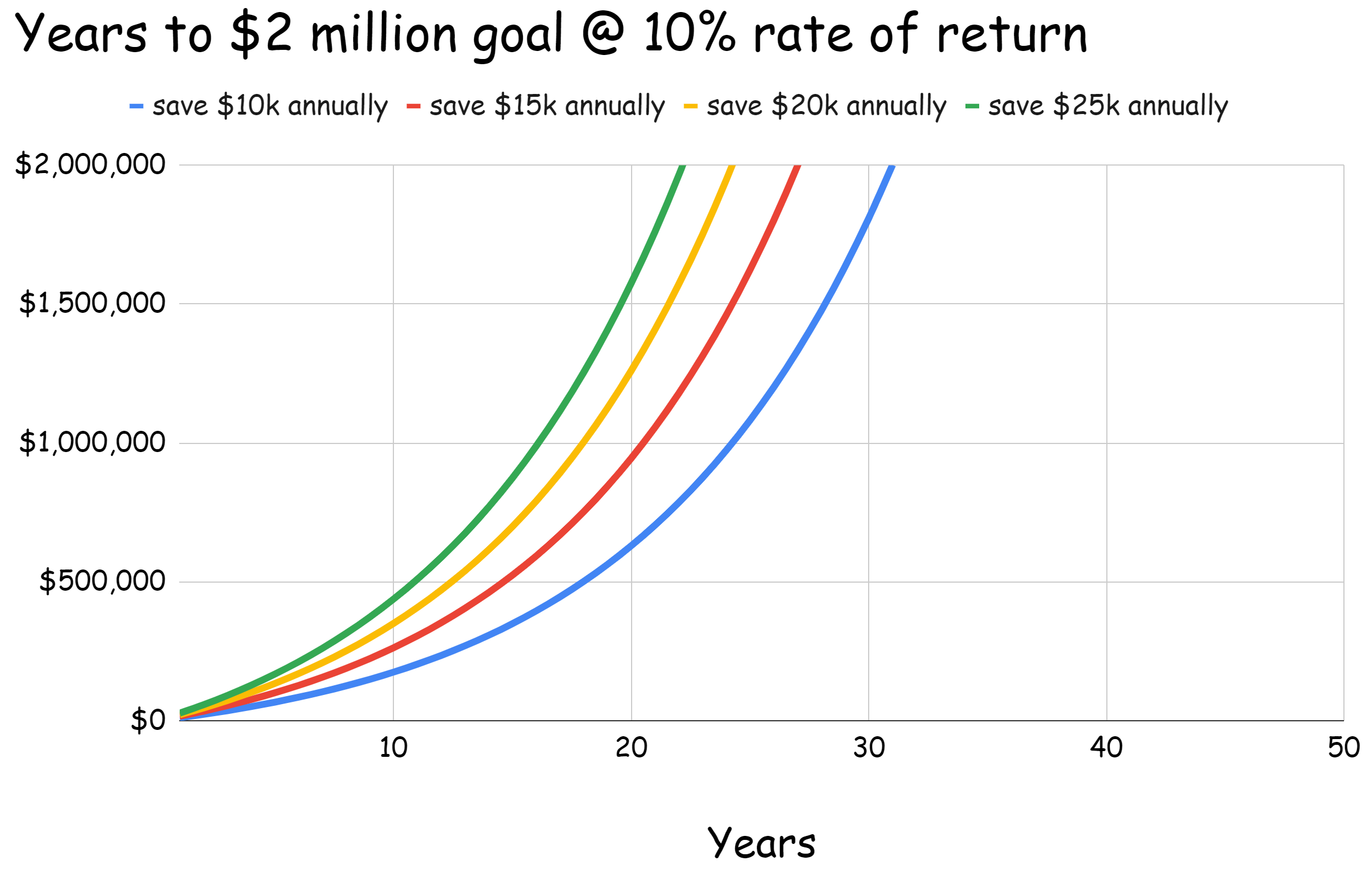

Maybe it’s not as evident so let’s try two more rates of returns – 10% and 12%. I would definitely not count on that kind of a rate of returns for the near future but let’s just see.

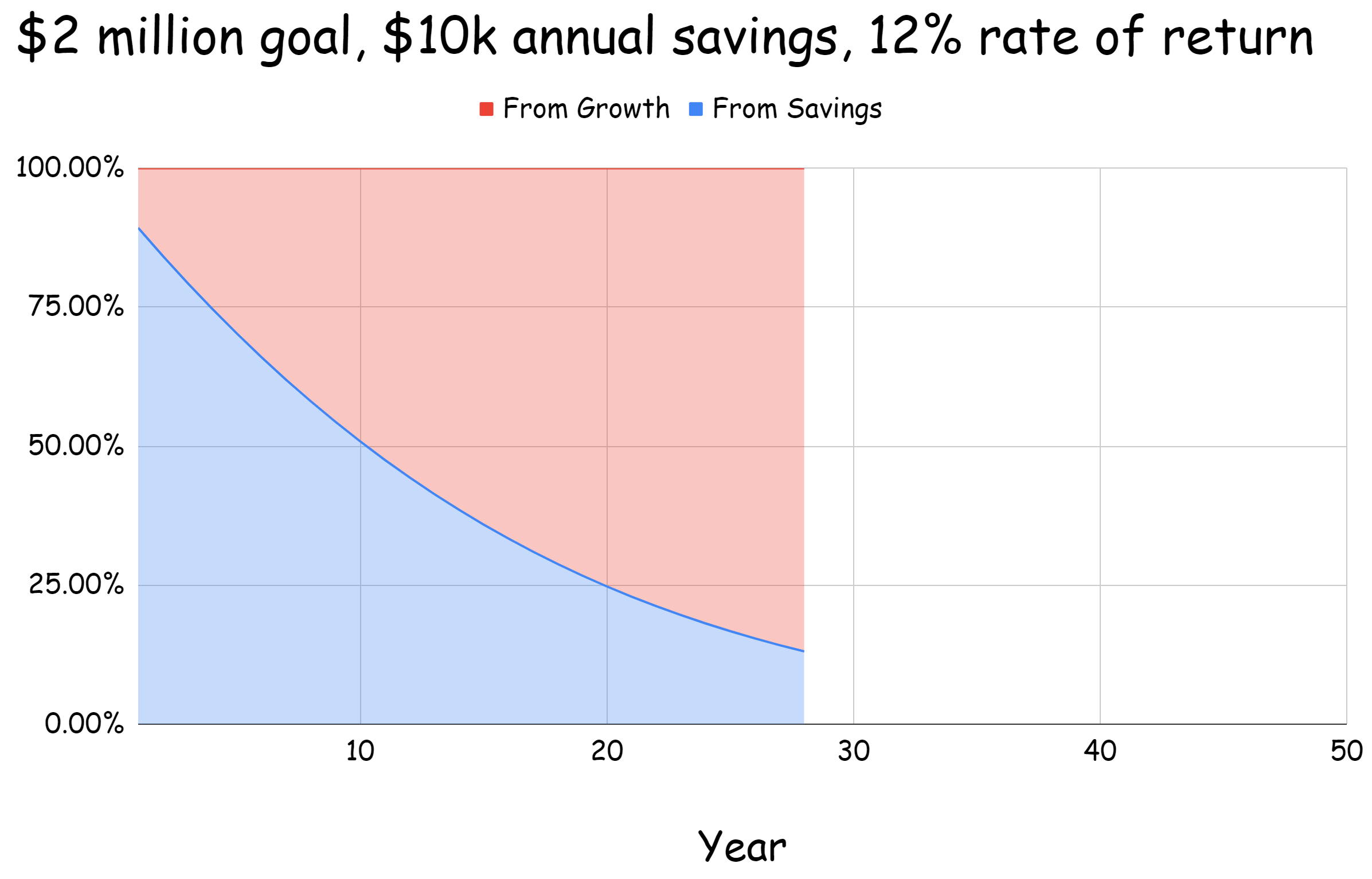

So as the rate of return increases, the effectiveness of saving more decreases. And that makes sense. With a lower rate of return, the amount you save is a bigger proportion of the total accumulated wealth, especially in the early years as shown below.

But with a 12% rate of return, the proportion of total wealth that comes from pure savings drops at a much quicker rate with growth taking over. So you don’t have to try as hard. I mean you don’t have to scrimp and save but I hope it is not a sacrifice.

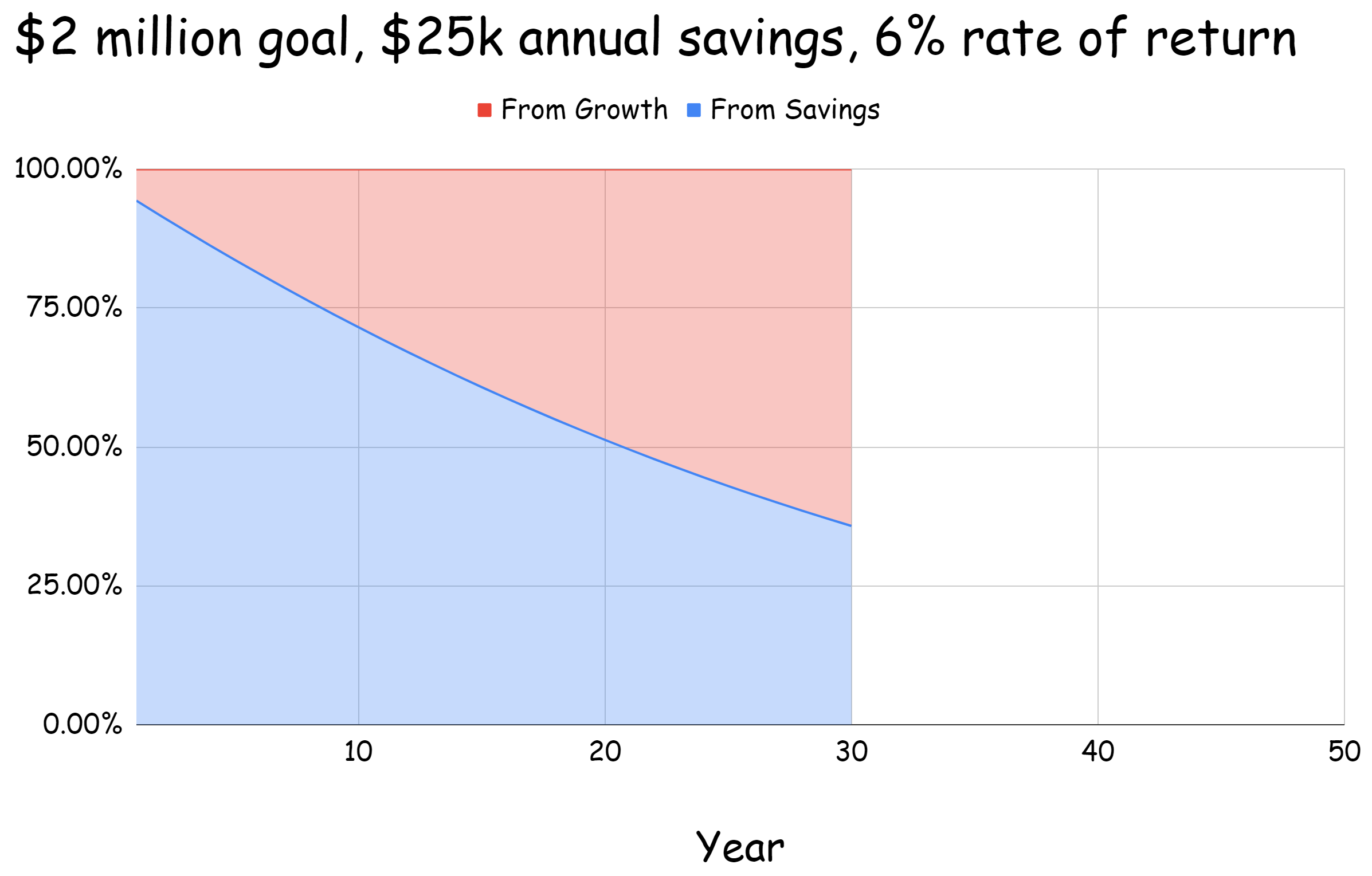

But we know that we are supposed to plan for the worst and hope for the best so with that in mind, what if you want to reach your goal in the same number of years as 12% rate of return does but assuming only a 6% rate of return? You can but you just have to save more as shown below.

So like before, the saving component is a bigger contributor to your total wealth. And you didn’t have to try as hard. I mean you didn’t have to take undue amount of risks to avail of that mystical 12% rate of return. For each and every year. For decades.

All you had to do is save more which is a much safer bet. And $25,000 a year might feel tough in the initial years but over time, as you grow and as your income grows, it gets easier and easier.

That’s about it.

Thank you for reading.

Cover image credit – Anna Shvets, Pexels