Vladimir Lenin once said that there are decades where nothing happens. And then there are weeks where decades happen. The last many weeks feel like that but if we go back in time and run through all the bad that has happened, this is no biggie and this too shall pass.

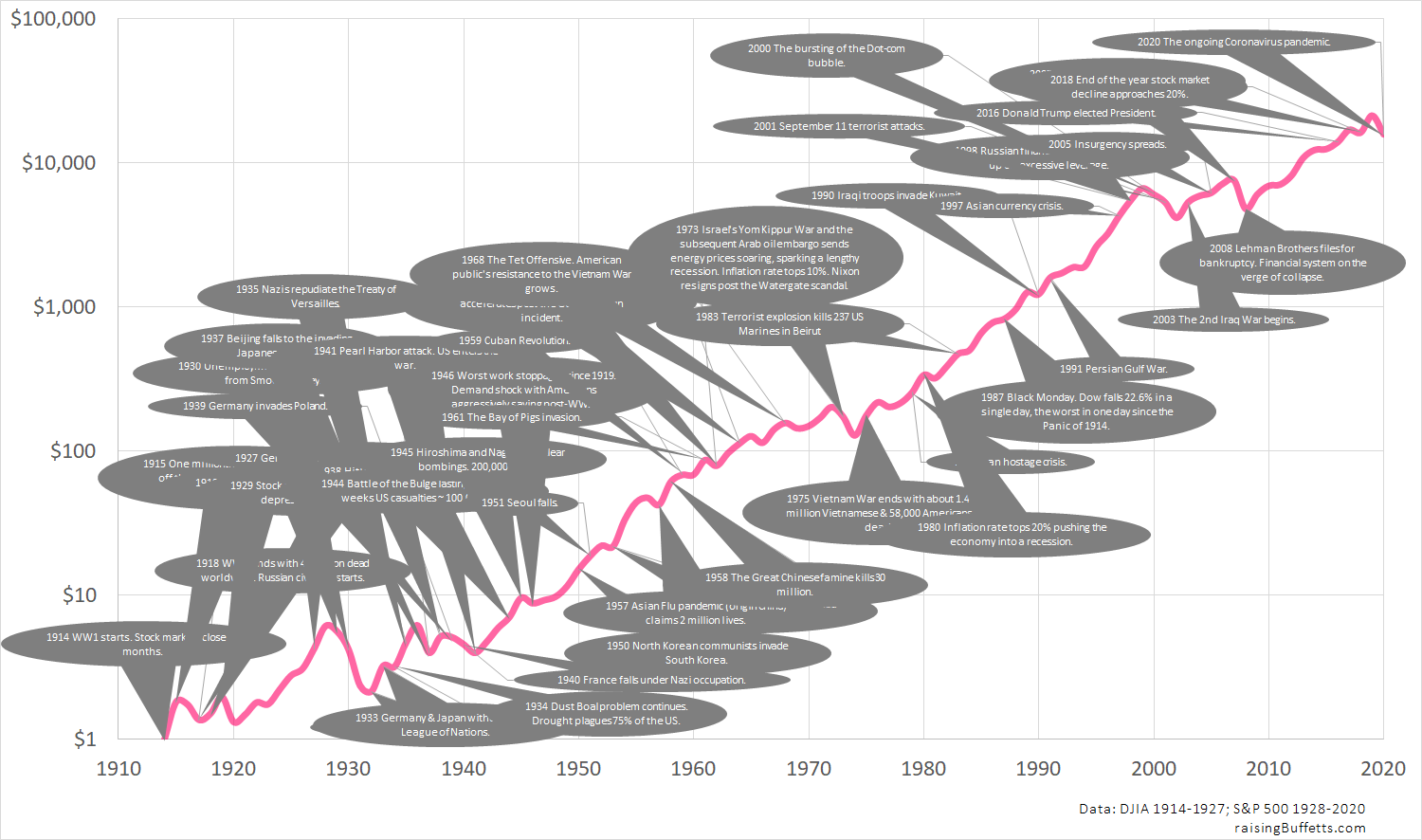

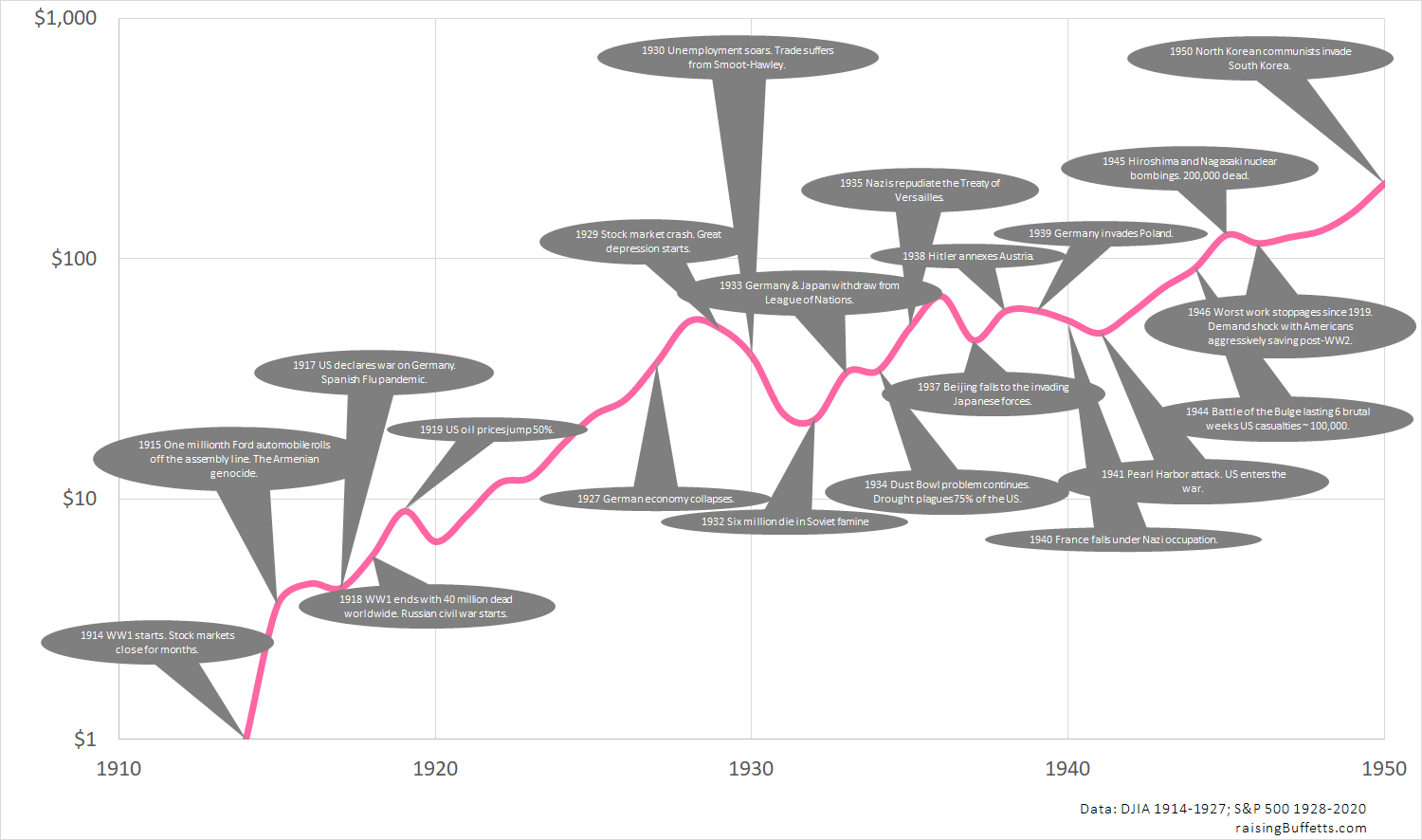

How do I know? Let’s run through some of the events the world has persevered through and yet capitalism marched on. The plot below is the growth of a dollar invested towards the end of 1914 in a basket of U.S. stocks and left there untouched since.

That story likely repeats for global stocks as well but because of limited data going that far back, we’ll use the data we have as a proxy.

And all these markers are events, mostly bad where if we were in the midst of them, we had every reason to bail. But had we not and remained invested, we did well.

Also, the y-axis above is log scale so those bumps that appear to be baby bumps are in fact deep craters that almost looked like it was the end of the world. But we are still here. You are still here.

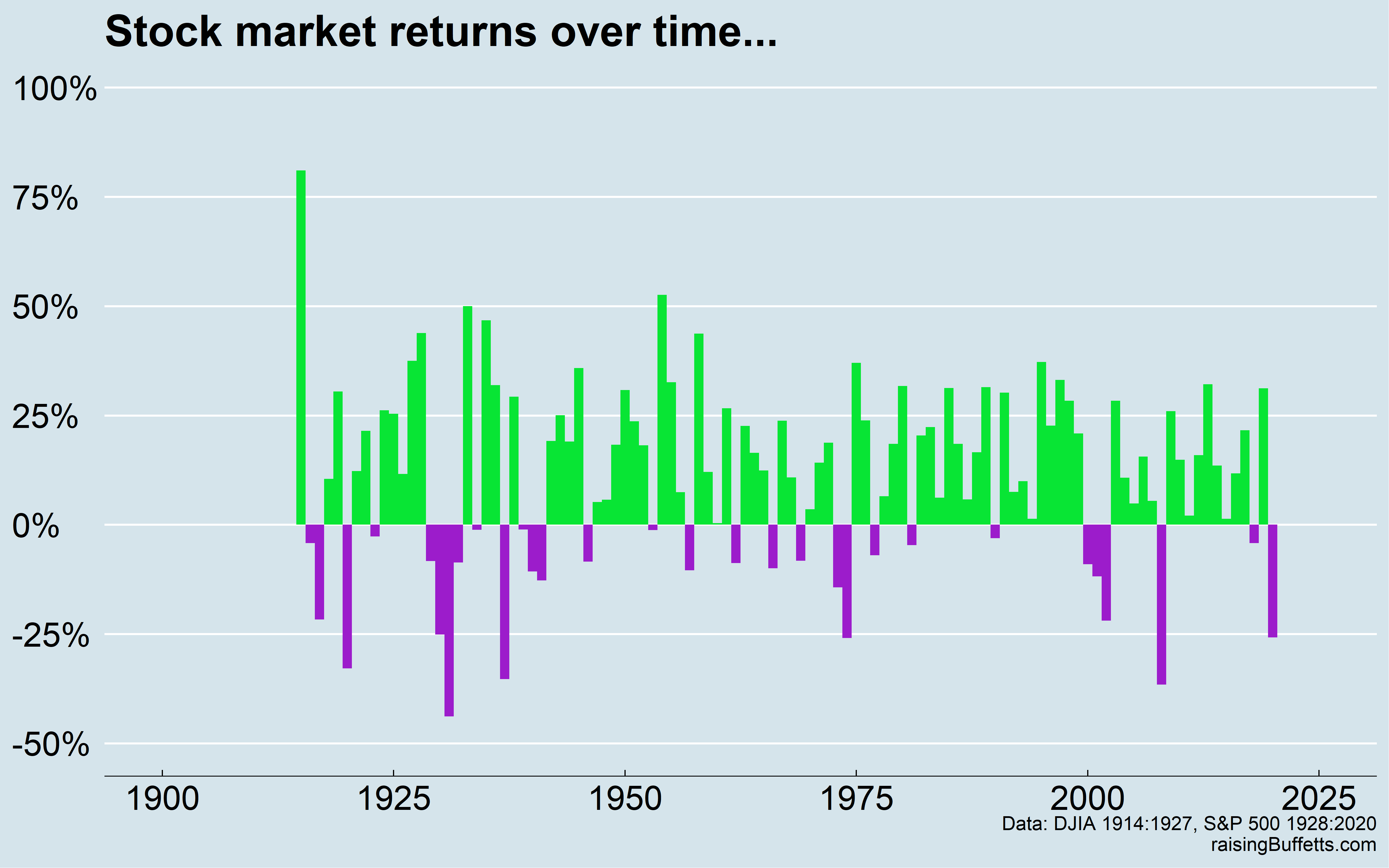

A cursory look at the market returns we would have to endure through to get here.

These are annualized returns that measures the value of a dollar invested from the start of each year to the end of that year. This does not capture the intra-year (within that year) volatility which many a times is massive. What I mean by that is that we might end a year with say a 7% portfolio return but we would have endured a 30% intra-year drawdown first to eventually recover enough and avail of that 7% return.

And that has happened and will continue to happen. Persevering through that and sticking to our well-crafted investment plans is the only choice we have. And that is the right choice.

It’s one thing to look at the annualized returns and think, no biggie. I can handle that.

But a year is a long, long time watching the value of our portfolios decline day after day, month after month. Only when passing through that phase do we really realize how excruciatingly painful it is. We are likely experiencing that now. But endure through that we must. That is part of the deal.

If one year decline is rough, multi-year declines like the period post the Dot-com crash or the 70’s bear market or during what we had to endure through during the Great Depression is 10x worse. Things eventually recover but we have to continue investing through that by sticking to our plans no matter what. That is the only choice. And that is the right choice.

But who has a 100-plus year timeframe to invest? Okay, so let’s break this timeline into smaller chunks.

1915-1950

Why the quote unquote around only? Let’s chronicle the events that transpired during this time span to find out. And a 35 year timeframe matches a typical career span so even better.

1914 Austrian Prince Archduke Francis Ferdinand travels to Sarajevo to inspect the imperial armed forces in Bosnia and Herzegovina, annexed by Austria-Hungary in 1908. The annexation had angered Serbian nationalists who believed the territories should be part of Serbia. A group of young nationalists hatch a plot to kill the Archduke during his visit to Sarajevo. After some missteps, 19-year-old Gavrilo Princip was able to shoot the royal couple at point-blank range while they traveled in their official procession, killing both almost instantly. The assassination sets off a rapid chain of events as Austria-Hungary immediately blames the Serbian government for the attack. As the large and powerful Russia supported Serbia, Austria asks for assurances that Germany would step in on its side against Russia and its allies that include France and Great Britain. On July 28, Austria-Hungary declares war on Serbia and the fragile peace between Europe’s great powers collapses, beginning the devastating conflict now known as the World War I.

1914 The outbreak of war forces NYSE to shut its doors on July 31, 1914 after large numbers of foreign investors start selling their holdings in hopes of raising money for the war effort. All of the world’s major financial markets follow suit and close their doors by August 1. It would be about 4 months the markets remain closed. Imagine that happening today.

1915 One millionth Ford automobile rolls off the assembly line. Concerns around the fact that the demand for oil will outstrip supply and that the world will run out of oil soon. And then what? The Peak Oil theory will remain a concern like forever and here we are today with the likes of Tesla relegating the fact that the world will ever run out of oil as a non-issue. Stocks gain 81% that year.

1915 The Armenian genocide. Between 600,000 to a million dead.

1917 U.S enters the war. Stock market declines by 22% that year.

1918 Worldwide influenza pandemic strikes (Spanish Flu). It continues till December of 1920 infecting around 500 million people, a quarter of the world’s population. Estimated death toll ~ between 17 million to 50 million and possibly as high as 100 million, making it one of the deadliest pandemics in human history. An estimated 675,000 Americans die. Stocks gain 11% that year.

1918 Germany signs the Armistice at Compiègne ending World War I. 20 million dead worldwide with 21 million wounded.

1918 Russian revolutionaries execute the former czar and his family leading to a Russian Civil War between Reds (Bolsheviks) and Whites (anti-Bolsheviks). Reds win in 1920 and hence the onset of worldwide communism.

1927 German economy collapses. Stocks gain 37% that year.

1929 The stock market crash on Oct. 29 marks the start of the Great Depression and sparks America’s and likely the world’s most famous bear market. The S&P 500 falls 86 percent in less than three years and does not regain its previous peak until 1954 (in price). Stocks decline 8% that year.

1930 Unemployment soars, trade suffers from Smoot-Hawley tariffs. U.S. imports from and exports to Europe fall by some two-thirds between 1929 and 1932 while overall global trade declines by similar levels in the four years that the legislation is in effect. Stocks decline another 25% that year.

1932 Six million die in Soviet famine. Stocks continue their decline (another 9%) after a horrific 44% decline the year before from the already depressed levels.

1933 Germany and Japan withdraw from League of Nations. Stocks soar 50%.

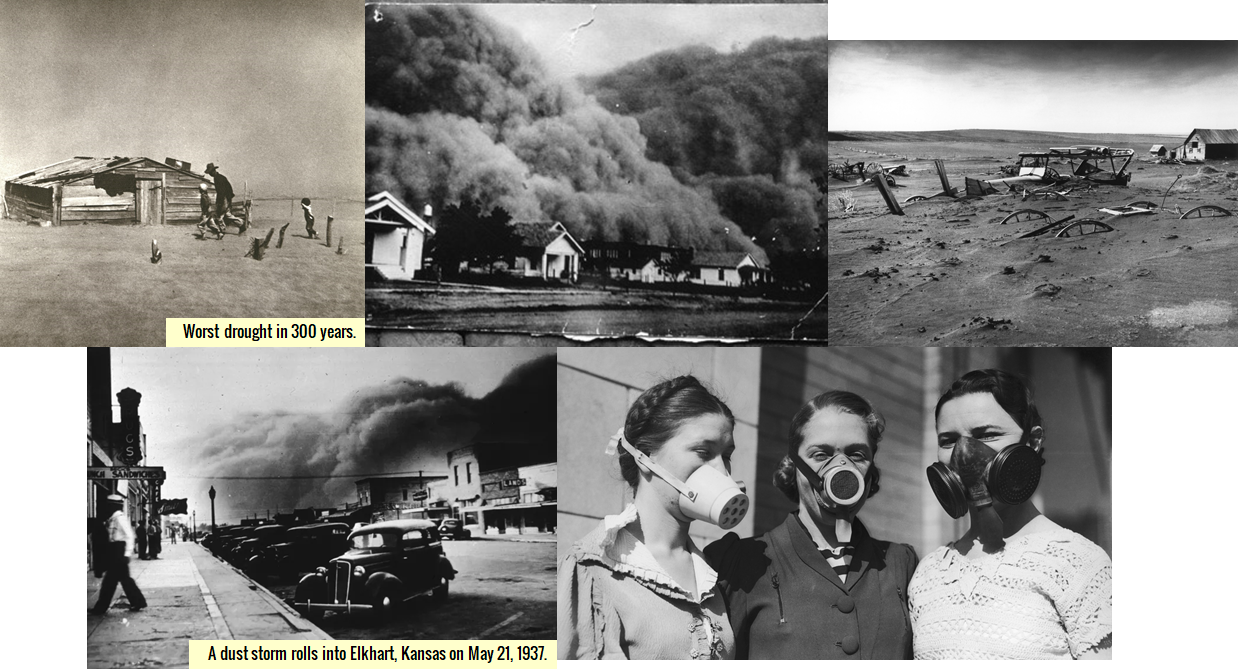

1934 Dust Bowl problem continues. The worst drought in 300 years plagues 75% of the country. Stocks remain almost flat for the year.

1935 Nazis repudiate Treaty of Versailles. Stocks gain 47%.

1937 Beijing falls to the invading Japanese forces. Stocks decline 35%.

1938 Hitler annexes Austria. A 29% stock market gain.

1939 Germany invades Poland. Stocks close flat for the year.

1940 France falls under Nazi occupation. Stocks decline 11%.

1941 Pearl Harbor attack. US enters World War II. Stocks decline another 13%.

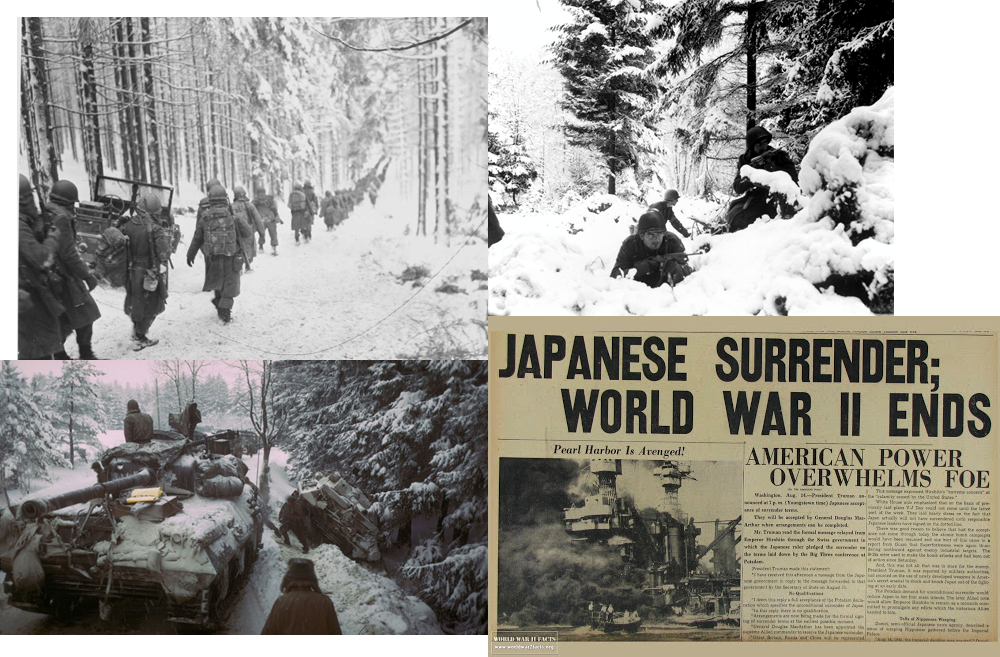

1944 The Battle of the Bulge called “the Greatest American battle of the war” by Winston Churchill. Fought in the Ardennes region of Belgium, this was Adolf Hitler’s last major offensive in the war against the Western Front. Hitler’s aim was to split the Allies in their drive toward Germany. The German troops failure to divide Britain, France and America with the Ardennes offensive paved the way to victory for the allies. Lasting six brutal weeks, from December 16, 1944, to January 25, 1945, the assault, also called the Battle of the Ardennes, took place during frigid weather conditions with some 30 German divisions attacking battle-fatigued American troops across 85 miles of the densely wooded Ardennes Forest. As the Germans drove into the Ardennes, the Allied line took on the appearance of a large bulge, giving rise to the battle’s name. The battle proved to be the costliest ever fought by the U.S. Army (about 100,000 casualties). Stocks gain 19%.

1945 Hiroshima and Nagasaki nuclear bombings. 200,000 dead. Stocks gain 36%.

1946 Worst work stoppages since 1919. Less than a year after the end of World War II, stock prices peak and begin a long slide. As the postwar surge in demand tapers off and Americans pour their money into savings, the economy tips into a sharp “inventory recession”. Stocks decline 8%.

1950 North Korean communists invade South Korea. Stock market gains 31%.

So this 35-year timeline that includes the Great Depression, two World Wars, pandemics and every unimaginably bad thing that could have ever happened to this world and we still came out okay being invested in capitalism.

And if there was ever such a thing as financial planning in those days and you panicked and deviated from the plan you had in place and sold at any point in time, well that would have been a sin. Not the greatest of sins but a sin. Why?

The financial underpinnings of the world were still in the early formative stages. The Federal Reserve bank that acts like a stabilizing force during times of economic upheaval today didn’t even exist up until 1913. And even when it did, there was not a lot of data and expertise on how to navigate around pandemics and wars and recessions. Everybody was learning. The system was learning with the world waffling back and forth between two distinct economic systems.

So you were forgiven if you had committed that ultimate sin but had you not and dollar cost averaged into the markets during those 35 years by investing a dollar each year, this is what you’d have.

So instead of $15, you end up with an amount 13x more. That’s hail to the power of an ironclad gut, a long-term mindset and dollar cost averaging. And notice that reduction in volatility because of your consistency in adding to your portfolio no matter what.

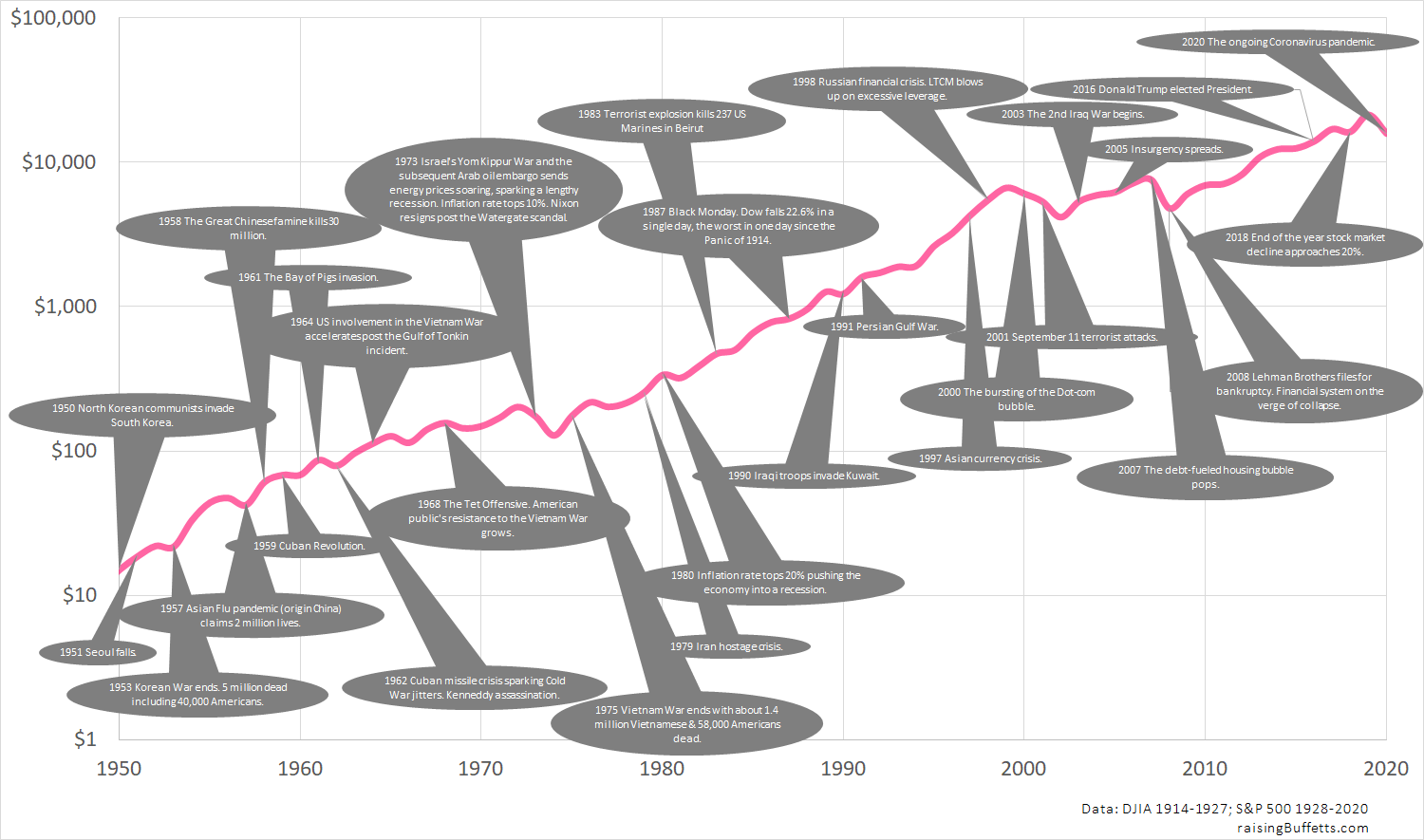

Let’s finish off this timeline thingy by recounting the major events that happened 1951 hence and the journey of that dollar that you (or your prescient ancestors) started in 1914.

1951-2020

1951 Seoul falls to Communist forces. Stocks gain 24%.

1953 The Korean War ends with the signing of the Korean Armistice Agreement. The agreement creates the Korean Demilitarized Zone (DMZ) to separate North and South Korea and allows the return of prisoners. However, no peace treaty is signed and the two Koreas are technically still at war, engaged in a frozen conflict. The Korean War is relatively short but exceptionally bloody. Nearly 5 million people die with more than half of them, civilians. Almost 40,000 Americans die in action in Korea with more than 100,000 wounded. Stocks remain flat for the year.

1957 Asian Flu Pandemic (a Chinese origin H2N2 avian influenza) claims 2 million lives. Stocks decline 10% that year.

1958 The Great Chinese famine kills 30 million. Stocks gain 44%.

1959 The Cuban Revolution – communism at America’s doorstep. Stocks gain 12%.

1961 The Bay of Pigs invasion – a failed attempt at ousting Fidel Castro from power. Stocks gain 27%.

1962 Cuban missile crisis sparks Cold War jitters. President Kennedy is assassinated. Stocks decline 9%.

1964 U.S. involvement in the Vietnam War accelerates post the Gulf of Tonkin incident. U.S. also conducts large-scale strategic bombing campaigns against North Vietnam and Laos. Stocks gain 16%.

1968 The Tet Offensive. American public’s resistance to the Vietnam War grows. Despite heavy casualties, North Vietnam achieves a strategic victory with the Tet Offensive as the attacks mark a turning point in the Vietnam War and the beginning of a slow and painful American withdrawal from the region. Stocks gain 11%.

1973 Israel’s Yom Kippur War and the subsequent Arab oil embargo sends energy prices soaring. A lengthy recession ensues. Inflation rate tops 10%. Nixon resigns post the Watergate scandal. Stocks drop 14%.

1975 Vietnam War ends with about 1.4 million Vietnamese and 58,000 Americans dead. Stocks gain 37%.

1979 Iran hostage crisis. Stocks gain 19%.

1980 After nearly a decade of sustained inflation, the Federal Reserve raises interest rates to nearly 20 percent, pushing the economy into a recession. The combination of high inflation and slow growth (stagflation) was a big factor behind Ronald Reagan’s victory over President Carter. Stocks gain 31%.

1983 Terrorist explosion kills 237 U.S. Marines in Beirut. Stocks gain 22%.

1987 Black Monday. Dow falls 22.6% in a single day, the worst in one day since the Panic of 1914. Yet, while the days after the crash were frightening, by early December, the markets bottom out and a new bull run commences. Stocks go on to not only make back all the losses but end the year +6%.

1990 Iraqi troops invade Kuwait. Stocks decline 3%.

1991 The Persian Gulf War. Stocks deliver a 30% return.

1997 The Asian currency crisis. The crisis starts in Thailand on July 2nd with the collapse of the Thai baht after the Thai government is forced to free-float the baht due to lack of foreign currency reserves that previously supported its peg to the U.S. dollar. Capital flight ensues almost immediately beginning an international chain reaction. At the time, Thailand had borrowed heavily that made the country effectively bankrupt even before the collapse of its currency. As the crisis spreads, most of Southeast Asia and Japan see slumping currencies, devalued stock markets, depressed real assets and a precipitous rise in private debt. Stocks earn 33% that year.

1998 The Russian financial crisis. Long Term Capital Management blows up on excessive leverage. Stock market gains 28%.

2000 The bursting of the Dot-com bubble. Stocks decline 9%.

2001 September 11 terrorist attacks. Stocks decline another 12%.

2003 The 2nd Iraq War begins. Stocks gain 28%.

2005 Insurgency spreads. Stocks gain 5%.

2007 A long-feared bursting of the housing bubble becomes a reality and the rising mortgage delinquency rate quickly spills over into the credit markets. By 2008, Wall Street giants like Bear Stearns and Lehman Brothers start toppling and a financial crisis erupts into a full-fledged panic. By February of 2008, the market falls to its lowest levels since 1997. Stocks earn 5% that year.

2008 Lehman Brothers files for bankruptcy. The global financial system is on the verge of collapse. Stocks end the year down 37%.

2016 Donald Trump elected President. Stocks gain 12%.

2018 End of the year stock market decline approaches 20%. Stocks end the year down 4%.

2020 The ongoing Coronavirus pandemic. A 26% decline so far.

I understand any amount of chronicling of history is not enough in light of the mayhem we have seen in the markets and in our portfolios lately. And these are also the times that remind us of the role bonds and cash play in our portfolios if drawing income to live on is a necessity. For the rest of us, we did right by sticking with the portfolios we own.

But these are also the type of events that separate us from folks who commit the ultimate investing sin if there was ever and that is to panic sell. There is no reason to and there is no need to. Granted, there will be some restructuring in the global economic landscape in light of this pandemic. Weaker companies will fail and the stronger ones will come out even stronger than before. And you don’t want to be there picking winners and losers because you are statistically much more likely to own losers than winners. You want the market to sort this out and it will over time.

This world of ours has endured far worse and we see that. We would come out of this just fine. I bet we would be looking back in a decade on this entire episode and say that was nothing. The world has seen far worse.

And if you are in your twenties or thirties or even in your forties and you are new to this market volatility, I say this: you will have many such episodes in your life when your portfolio massively declines in value, sometimes for a reason and other times, without any. But you have to remain invested because that is part and parcel of this whole process of getting from point A to point B and beyond.

And for the finance nerds out there, when we invest in stocks, we are in fact buying perpetuities that promise to deliver a stream of cash flows this year, next year and many years beyond that, discounted at an appropriate discount rate to the present day. This episode we are living through will impair a few years’ worth of those cash flows but the longer term cash flows will eventually come through. They have to.

Markets tend to overextend on the way up and on the way down. That’s natural. But remember, things are never as bad as they seem when all hell is breaking loose and you are in the midst of that. At the same time, things are never as good as they seem when everything is going great.

So plan for things to go bad when things are going well. And when things look miserable, keep in mind that things will eventually get better.

So don’t go crazy not having any safety buffer to tide you through in situations where your income gets disrupted temporarily. At the same time, don’t panic.

And if you are a market participant (you have to be, you have no other choice), you’ve got to own stocks. There is no plan you can theoretically design in today’s interest rate environment where you can avoid that asset class completely. But when you do own stocks, you’ve got to be prepared for declines every now and then because as Charlie Munger says…

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who do have the temperament and who can be more philosophical about these market fluctuations.”

Not sure about being philosophical…okay, I can be a bit philosophical but if it makes you feel any better, this is a small collection of businesses amongst the thousands you own if you own a global market portfolio. And they are selling at a discount. So buy if you can.

Some companies will burn and die but capitalism will survive. It has to because… Pascal’s Wager?

The only folks who get absolutely demolished in bad times are the ones who take on excessive leverage. The only leverage that you should very reluctantly sign up for in your own personal life is your home mortgage. And very, very reluctantly at that.

And leverage, especially with stocks, never. Because I am with The Oracle on this…

“It’s insane to risk what you have and need for something you don’t really need. You will not be way happier if you double your net worth.”

And Black Swan events like these is when we see the folks flirting with leverage get completely wiped out. Those 10 AirBnB rentals that you thought you could lever up and make a killing? Not happening. That’s the nature of blind risk and capitalism has a way to cleanse the system every once in a while. That’s ultimately healthy but you don’t want to be a part of that process.

But never in my wildest imagination did I predict these unfolding of events not only with the markets but with our lives. I have been hoping and praying that there would be a correction to clean out the excesses because I feared that the longer the good times rolled, the more remote a chance of a decline will seem, the more overconfident investors will feel and the more risk they’ll take. Which means that that eventual fall, which is a near certainty, would be far more deep and wide.

But what about all those folks who got out just in time before the markets crashed and will likely get back in before they recover?

Yes, of course. And I have a bronze colored bridge I’d like to part with at the right price.

You might get lucky timing the getting out part once or maybe twice in your life but you also have to get the getting in part right. And markets don’t usually recover when you think they’ll recover. They make big and sudden moves which will catch you off-guard and you then miss the boat. Plus these moves tend to happen at the bleakest of times when all hope is lost.

And say you got out in time before the crash and you got back in at the bottom. So you got lucky twice. What’s the lesson you learnt? That the moment you have that inkling of a disaster on the horizon in the future, you’ll get out. And that disaster never happens. Or it happens but it’s not as severe and the markets zoom past the point you sold. What happens then? You wait? Wait for a decade?

Because that is precisely what many investors did this past decade and hence missed out on all those gains before these recent spate of events.

So don’t mess around. Remain invested.

Good investing is a lot about psychology and behavior combined with a decent dose of history with a sprinkle of math and finance. Any one of them missing from the mix and it’s going to be real hard to meet your goals.

And getting sucked into a fad here and a fad there and assembling investments with no particular rhyme or reason beyond hoping that you buy low and you will get to sell higher is not what it’s all about. I have seen folks talk about this airline stock or that cruise stock. Fine. A few of them will work out but what’s the definition of working out? A double or a triple? Pre-tax?

And you for sure didn’t stake the kind of money that’ll change your life. So if you didn’t, don’t bother. Stick to your plan.

I am not saying you have to but maybe you’ve got to have someone who knows these things watch over your financial life. Because as Phil Demuth, author of several excellent books and the founder of Conservative Wealth Management opines…

“If you manage your own money, you are potentially vulnerable to every crackpot investing idea that comes along. It only takes one.”

Only one. Maybe you will but most don’t get many shots at this. So act wisely.

And what I am truly worried about is the long-term health of our retirement system because when I see stats like an average retiree nearing retirement has only $50,000 saved, I say holy s#*@. We are screwed. Because as William Bernstein says…

“I’ve flown airplanes, and as a doctor, I’ve taken care of kids who can’t walk. Investing for retirement is probably harder than either of those two activities, yet we expect people to be able to do it on their own.”

And that’s why we all yearn for those pension systems of the past where we had someone other than us pool assets together with our fellow savers and design a plan with enough safeguards to make sure that the money lasts longer than any of us individually.

That don’t exist and we’ll have to live with that. In the meantime, a few tips to navigate around this and future market turbulences.

- Always, always keep emergency reserves that cover at the minimum 6 months of living expenses. And depending upon the type of work you do, maybe you need more but 6 months is the ideal minimum. Granted, it is a tall order for many folks who cannot afford to set aside literally anything because they can’t. But I know you can. How? Because you got this far reading this.

- Never panic. You will encounter many a market crashes and recessions through your investing life. You just have to acknowledge that fact and design a plan that lets you survive those events. You need to realize your own volatility to heartburn ratio and this is the time to take notes. The higher that ratio, the more equity risk you can handle and the higher the returns you can expect. A lower ratio means that you’ll sleep alright but then you have to be prepared to save ungodly sums of money to maintain the same standard of living as before through a likely long retirement.

- It’s obvious but try to avoid taking on too much debt of any kind, especially of the lifestyle kind. Screw that big home with an albatross as a mortgage if it bogs you down. It’s unfortunate that we as a country through our tax policies and incentives have turned shelter into an asset class. And a retirement plan. That’s stupid and real bad in the long run, not only for you as a home owner but also for future economic growth. And environmental costs aside, it locks people in place, decreases social mobility and increases risks in the system and in our lives. Let others participate in this game but you remain mindful of the debt you take on.

- Never borrow and invest, ever. We’ll see the repercussions of that soon as a lot of over-leveraged real estate ventures and businesses go belly up. I mean all these folks were running their ’empires’ in a way that they could not sustain a couple months of income disruption? Come on.

- And stay far, far away with that mindset of Keeping Up with the Joneses. Design your life around being happy with as small an overhead as possible. The freedom and the peace of mind that comes with that will be priceless. You’ll sleep better, play better and work better. All good.

So that’s all I have to say for now. Thank you for reading.

Until later.

Cover image credit: Josie Stephens, Pexels